Cost Efficiency and Scalability

Cost efficiency and scalability are emerging as key drivers for the high performance-computing-as-a-service market. Organizations are increasingly seeking flexible computing solutions that allow them to scale resources according to their needs without incurring significant capital expenditures. By adopting high performance computing as a service, businesses can reduce their operational costs while gaining access to cutting-edge technology. This model is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the resources to invest in on-premises infrastructure. The The high performance-computing-as-a-service market is likely to continue growing as more organizations recognize the financial benefits and operational flexibility this approach offers.

Advancements in Network Infrastructure

The evolution of network infrastructure is a pivotal driver for the high performance-computing-as-a-service market. Enhanced connectivity solutions, such as 5G and fibre-optic networks, are enabling faster data transfer rates and lower latency, which are crucial for high performance computing applications. This advancement allows organizations to access and process large datasets more efficiently, thereby improving overall productivity. The UK government has been investing in digital infrastructure, with plans to allocate £5 billion towards improving broadband access. Such initiatives are likely to bolster the high performance-computing-as-a-service market by facilitating seamless integration of cloud-based solutions and enabling businesses to harness the full potential of high performance computing.

Regulatory Compliance and Data Security

Regulatory compliance and data security concerns are becoming increasingly prominent drivers for the high performance-computing-as-a-service market. As organizations handle sensitive data, they must adhere to stringent regulations such as the General Data Protection Regulation (GDPR). This necessitates the adoption of secure computing solutions that can ensure data integrity and confidentiality. High performance computing providers are responding by implementing robust security measures and compliance protocols, which are essential for gaining the trust of clients. The emphasis on data security is likely to propel the high performance-computing-as-a-service market, as organizations prioritize solutions that not only meet regulatory requirements but also safeguard their valuable data assets.

Increased Focus on Research and Development

The The high performance-computing-as-a-service market is significantly influenced by the increased focus on research and development (R&D) across various industries. The UK government has committed substantial funding to support R&D initiatives, with an aim to reach £22 billion annually by 2024. This investment is expected to drive innovation and technological advancements, particularly in sectors such as pharmaceuticals, aerospace, and artificial intelligence. As organizations strive to remain competitive, they are increasingly turning to high performance computing solutions to accelerate their R&D processes. This trend not only enhances the capabilities of researchers but also positions the high performance-computing-as-a-service market as a critical enabler of scientific breakthroughs and technological progress.

Growing Demand for Data-Intensive Applications

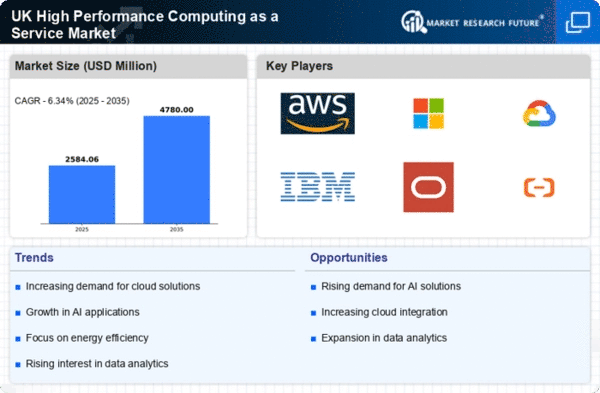

The high performance-computing-as-a-service market is experiencing a surge in demand driven by the increasing reliance on data-intensive applications across various sectors. Industries such as finance, healthcare, and scientific research are increasingly adopting solutions that require substantial computational power. For instance, the financial sector is leveraging high performance computing for real-time analytics and risk assessment, while healthcare is utilizing it for genomic research and drug discovery. This trend is reflected in the market's projected growth, with estimates suggesting a compound annual growth rate (CAGR) of approximately 15% over the next five years. As organizations seek to enhance their operational efficiency and innovation capabilities, the The high performance-computing-as-a-service market is set to benefit significantly from this growing demand.