Rising Environmental Concerns

The increasing awareness of environmental issues in France is driving the direct methanol-fuel-cell market. As the nation strives to meet its climate goals, there is a growing emphasis on reducing greenhouse gas emissions. The direct methanol-fuel-cell technology offers a cleaner alternative to traditional fossil fuels, potentially reducing carbon emissions by up to 30%. This shift aligns with France's commitment to the Paris Agreement, which aims to limit global warming. Consequently, the demand for cleaner energy solutions is likely to propel the direct methanol-fuel-cell market forward, as both consumers and businesses seek sustainable options. The French government has also introduced incentives for adopting green technologies, further stimulating market growth. This trend indicates a robust future for the direct methanol-fuel-cell market as it aligns with national and global sustainability objectives.

Supportive Regulatory Framework

France's regulatory environment is increasingly supportive of alternative energy solutions, which is beneficial for the direct methanol-fuel-cell market. The government has implemented various policies aimed at promoting renewable energy sources and reducing reliance on fossil fuels. For instance, the Energy Transition Law encourages investments in clean technologies, including fuel cells. This regulatory framework not only provides financial incentives but also establishes standards that facilitate the adoption of direct methanol-fuel-cell systems. As a result, manufacturers and consumers are more likely to invest in this technology, anticipating favorable conditions for growth. The direct methanol-fuel-cell market is expected to thrive under these supportive regulations, as they create a conducive environment for innovation and investment in sustainable energy solutions.

Advancements in Fuel Cell Technology

Technological innovations in fuel cell systems are significantly impacting the direct methanol-fuel-cell market. Recent developments have led to improved efficiency and reduced costs, making these systems more accessible to consumers and businesses in France. For example, advancements in catalyst materials and membrane technology have enhanced the performance of direct methanol-fuel cells, potentially increasing their efficiency by up to 20%. This progress not only makes the technology more appealing but also positions it as a viable alternative to conventional energy sources. As manufacturers continue to innovate, the direct methanol-fuel-cell market is likely to expand, driven by the demand for more efficient and cost-effective energy solutions. The ongoing research and development efforts in this sector suggest a promising trajectory for the market in the coming years.

Consumer Demand for Energy Independence

In France, there is a notable consumer trend towards energy independence, which is driving interest in the direct methanol-fuel-cell market. As energy prices fluctuate and concerns about energy security grow, individuals and businesses are seeking alternative energy sources that provide greater control over their energy consumption. Direct methanol-fuel cells offer a decentralized energy solution, allowing users to generate their own power. This shift in consumer behavior is likely to increase the adoption of fuel cell technology, as it aligns with the desire for self-sufficiency. Market analysts suggest that this trend could lead to a 10% increase in the direct methanol-fuel-cell market over the next few years, as more consumers recognize the benefits of energy independence and sustainability.

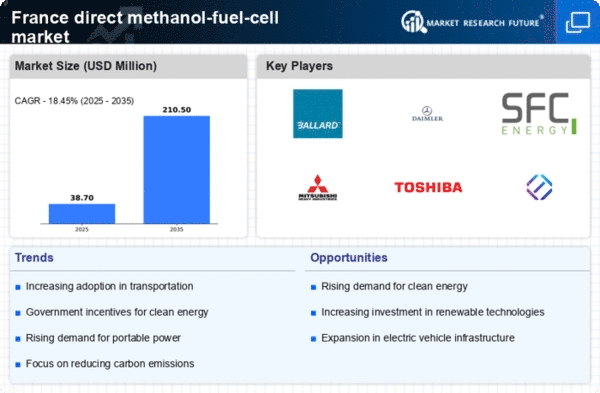

Increasing Applications in Transportation

The transportation sector in France is witnessing a shift towards cleaner energy solutions, which is positively influencing the direct methanol-fuel-cell market. With the rise of electric vehicles and the need for sustainable transport options, direct methanol-fuel cells are being explored as a viable power source for various applications, including buses and delivery vehicles. The French government has set ambitious targets for reducing emissions in transportation, which could lead to a market growth of up to 15% in the next five years. This trend indicates a growing acceptance of fuel cell technology in the automotive industry, as manufacturers seek to comply with stringent environmental regulations. The direct methanol-fuel-cell market stands to benefit from this transition, as it offers a practical solution for achieving cleaner transportation.