Increasing Environmental Awareness

The growing consciousness regarding environmental issues among the Canadian populace appears to be a significant driver for the direct methanol-fuel-cell market. As individuals and organizations become more aware of the detrimental effects of fossil fuels, there is a noticeable shift towards cleaner energy alternatives. This trend is reflected in the increasing investments in renewable energy technologies, with the Canadian government allocating approximately $1.5 billion to support clean energy initiatives. The direct methanol-fuel-cell market stands to benefit from this heightened awareness, as consumers and businesses alike seek sustainable solutions to reduce their carbon footprints. Furthermore, the emphasis on reducing greenhouse gas emissions aligns with the capabilities of direct methanol fuel cells, which offer a cleaner alternative to traditional energy sources. Thus, the rising environmental awareness is likely to propel the demand for this market in Canada.

Advancements in Fuel Cell Technology

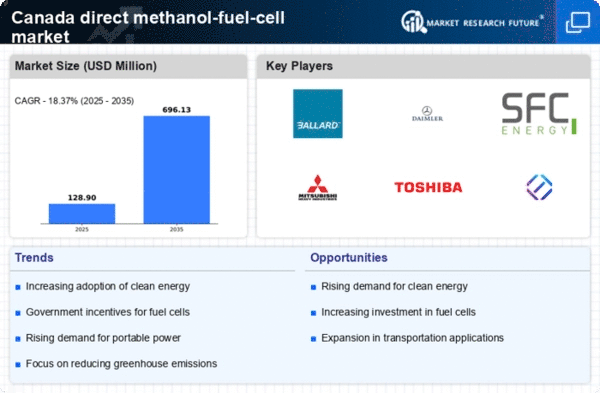

Technological innovations in fuel cell systems are playing a crucial role in shaping the direct methanol-fuel-cell market. Recent advancements have led to improved efficiency and reduced costs, making these systems more accessible to a broader range of applications. For instance, the development of new catalysts and membrane technologies has enhanced the performance of direct methanol fuel cells, allowing them to operate at lower temperatures and with higher power outputs. This is particularly relevant in Canada, where the market for portable power solutions is expanding. The direct methanol-fuel-cell market was projected to grow at a CAGR of 15% over the next five years, driven by these technological improvements. As manufacturers continue to innovate, the potential for widespread adoption in various sectors, including transportation and stationary power generation, becomes increasingly viable.

Focus on Energy Security and Independence

Energy security and independence are becoming increasingly important for Canada, influencing the direct methanol-fuel-cell market. As the country seeks to reduce its reliance on imported fossil fuels, there is a concerted effort to develop alternative energy sources. Direct methanol fuel cells, which can utilize domestically produced methanol, present a viable solution to enhance energy security. The Canadian government has set ambitious targets to increase the share of renewable energy in the national energy mix, aiming for 50% by 2030. This focus on energy independence is likely to drive investments in the direct methanol-fuel-cell market, as stakeholders recognize the potential for these technologies to contribute to a more sustainable and self-sufficient energy landscape.

Government Incentives for Clean Technology

The Canadian government has implemented various incentives aimed at promoting clean technology, which significantly impacts the direct methanol-fuel-cell market. Programs such as the Clean Growth Program and the Innovation Superclusters Initiative provide funding and support for research and development in clean energy technologies. These initiatives are designed to foster innovation and accelerate the commercialization of sustainable solutions. In 2025, the government has committed to investing over $2 billion in clean technology projects, which includes support for fuel cell technologies. This financial backing not only encourages research but also helps lower the barriers to entry for new companies in the direct methanol-fuel-cell market. As a result, the market is likely to experience increased competition and innovation, further driving growth in the sector.

Rising Demand for Portable Power Solutions

The demand for portable power solutions in Canada is on the rise, which is likely to benefit the direct methanol-fuel-cell market. As outdoor activities and mobile applications become more popular, there is a growing need for reliable and efficient power sources. Direct methanol fuel cells offer a lightweight and compact alternative to traditional batteries, making them particularly appealing for portable applications. The market for portable power is expected to grow by 20% annually, driven by the increasing use of electronic devices and the need for sustainable energy solutions. This trend suggests that the direct methanol-fuel-cell market could see substantial growth as manufacturers develop products tailored to meet the needs of consumers seeking portable energy solutions.