Growth of IoT and Connected Devices

The proliferation of Internet of Things (IoT) devices is significantly impacting the big data market. In France, the number of connected devices is projected to reach over 50 million by 2026, generating vast amounts of data that require sophisticated analytics solutions. This influx of data presents both challenges and opportunities for businesses, as they must develop strategies to manage and analyze this information effectively. The big data market is responding by offering innovative solutions that can handle the scale and complexity of IoT data, thereby enabling organizations to harness insights that drive operational improvements and customer engagement.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are becoming increasingly critical in the big data market. In France, businesses are facing stringent regulations regarding data protection and privacy, such as the General Data Protection Regulation (GDPR). Compliance with these regulations necessitates robust data management practices, which in turn drives demand for big data solutions that ensure data integrity and security. The big data market is adapting by providing tools that help organizations navigate the complexities of data governance, thereby enabling them to maintain compliance while leveraging data for strategic advantage.

Emergence of Advanced Data Analytics Tools

The emergence of advanced data analytics tools is reshaping the big data market landscape. In France, organizations are increasingly adopting sophisticated analytics platforms that offer capabilities such as machine learning and predictive modeling. These tools enable businesses to analyze large volumes of data quickly and derive insights that were previously unattainable. The big data market is responding to this demand by developing innovative solutions that cater to the needs of various sectors, from finance to healthcare, thereby enhancing the ability to make data-driven decisions and improve overall business performance.

Rising Demand for Data-Driven Decision Making

The increasing emphasis on data-driven decision making is a pivotal driver in the big data market. Organizations across various sectors in France are recognizing the value of leveraging data analytics to enhance operational efficiency and strategic planning. According to recent studies, approximately 70% of French companies are investing in big data technologies to gain insights that inform their business strategies. This trend is likely to continue as firms seek to remain competitive in a rapidly evolving market landscape. The big data market is thus experiencing a surge in demand for tools and platforms that facilitate data analysis and visualization, enabling businesses to make informed decisions based on real-time data.

Investment in Artificial Intelligence Technologies

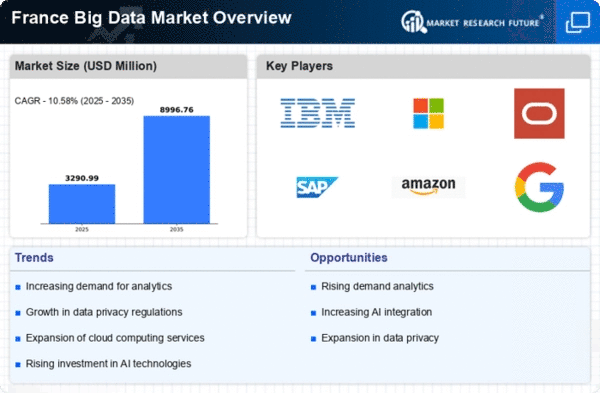

Investment in artificial intelligence (AI) technologies is a crucial driver for the big data market. In France, AI adoption is expected to grow at a compound annual growth rate (CAGR) of 25% over the next five years, with businesses increasingly integrating AI into their data analytics processes. This integration allows for more sophisticated data processing and predictive analytics, enhancing the ability to derive actionable insights from large datasets. The big data market is thus witnessing a surge in demand for AI-powered analytics tools, which can automate data analysis and improve decision-making capabilities across various sectors.