Growing Focus on Energy Efficiency

The Fluoropolymer (PTFE) Lined Pipes & Fittings Market is increasingly aligned with the global focus on energy efficiency. Industries are under pressure to reduce energy consumption and minimize waste, leading to a demand for piping systems that enhance operational efficiency. PTFE lined pipes and fittings are known for their low friction properties, which can contribute to reduced energy costs in fluid transport systems. As companies strive to optimize their processes and reduce their carbon footprint, the adoption of energy-efficient solutions is expected to rise. This trend is likely to create new opportunities for growth within the PTFE lined market.

Increasing Industrial Applications

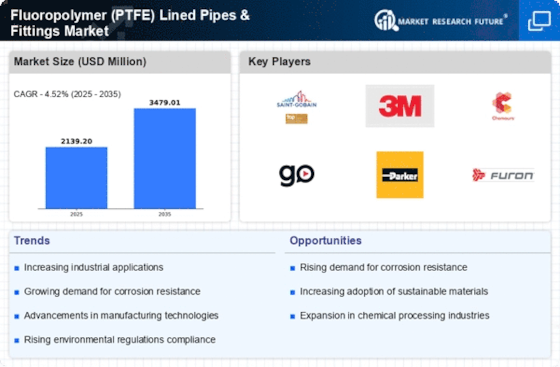

The Fluoropolymer (PTFE) Lined Pipes & Fittings Market is experiencing a surge in demand due to the increasing applications across various industrial sectors. Industries such as chemical processing, pharmaceuticals, and food and beverage are increasingly adopting PTFE lined solutions for their superior chemical resistance and durability. The versatility of PTFE lined pipes and fittings allows them to handle aggressive chemicals and extreme temperatures, making them essential in environments where traditional materials fail. As industries expand and evolve, the need for reliable and efficient piping systems becomes paramount. This trend is expected to drive significant growth in the market, with projections indicating a compound annual growth rate (CAGR) of around 5% over the next few years.

Advancements in Manufacturing Technologies

The Fluoropolymer (PTFE) Lined Pipes & Fittings Market is benefiting from advancements in manufacturing technologies. Innovations in production processes have led to improved quality and performance of PTFE lined products. Enhanced manufacturing techniques allow for better precision in the lining process, resulting in more durable and reliable piping systems. This technological evolution not only increases the lifespan of the products but also reduces maintenance costs for end-users. As manufacturers continue to invest in research and development, the market is likely to see a rise in the introduction of new and improved PTFE lined solutions, catering to the diverse needs of various industries.

Regulatory Compliance and Safety Standards

The Fluoropolymer (PTFE) Lined Pipes & Fittings Market is significantly influenced by stringent regulatory compliance and safety standards. Industries are increasingly required to adhere to regulations that mandate the use of materials that can withstand harsh chemicals and high temperatures without compromising safety. PTFE lined pipes and fittings are recognized for their ability to meet these rigorous standards, thus ensuring safe operations in hazardous environments. The growing emphasis on workplace safety and environmental protection is likely to propel the demand for PTFE lined solutions. As regulations evolve, companies are compelled to invest in high-quality materials, further driving the market's growth.

Rising Demand for High Purity Applications

The Fluoropolymer (PTFE) Lined Pipes & Fittings Market is witnessing a notable increase in demand for high purity applications. Sectors such as pharmaceuticals and biotechnology require piping systems that do not contaminate the transported materials. PTFE lined pipes are ideal for these applications due to their non-reactive nature and ability to maintain the integrity of sensitive substances. As the pharmaceutical industry continues to expand, the need for high purity piping solutions is expected to grow. This trend indicates a promising future for the PTFE lined market, as manufacturers seek to provide specialized solutions that meet the stringent requirements of high purity applications.