Rising Focus on Energy Efficiency

The fluoropolymer lined-pipes-fittings market is benefiting from a rising focus on energy efficiency within industrial operations. Companies are increasingly seeking solutions that not only reduce energy consumption but also enhance the overall performance of their systems. Fluoropolymer lined-pipes and fittings are known for their low friction properties, which can lead to reduced energy costs in fluid transport applications. As industries strive to lower their carbon footprints and improve sustainability, the adoption of energy-efficient piping solutions is likely to rise. This shift is expected to contribute to a market growth rate of approximately 5% annually, as organizations prioritize investments in technologies that align with their energy efficiency goals.

Increasing Industrial Applications

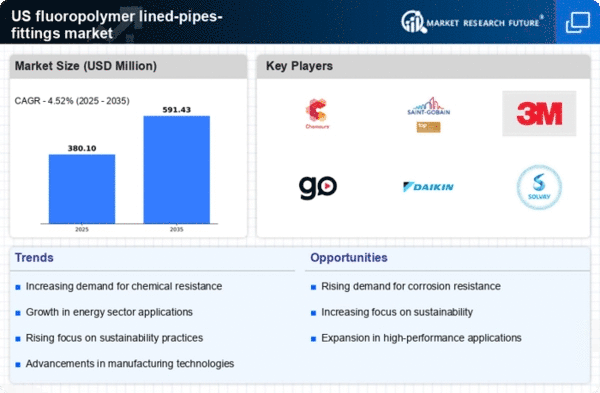

The fluoropolymer lined-pipes-fittings market is experiencing growth due to the increasing adoption of fluoropolymer-lined solutions across various industrial applications. Industries such as chemical processing, oil and gas, and pharmaceuticals are increasingly utilizing these products for their superior resistance to corrosive substances and high temperatures. The market is projected to expand as more companies recognize the benefits of using fluoropolymer lined-pipes and fittings, which can enhance operational efficiency and reduce maintenance costs. In 2025, the market is expected to reach a valuation of approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 6% over the next five years. This trend indicates a robust demand for fluoropolymer lined-pipes-fittings in sectors that require reliable and durable piping solutions.

Regulatory Compliance and Safety Standards

The fluoropolymer lined-pipes-fittings market is significantly influenced by stringent regulatory compliance and safety standards in the United States. Industries are mandated to adhere to regulations that ensure the safe handling of hazardous materials, which often necessitates the use of specialized piping systems. Fluoropolymer lined solutions are favored for their ability to meet these safety requirements, as they provide excellent chemical resistance and minimize the risk of leaks and spills. As regulatory bodies continue to enforce these standards, the demand for fluoropolymer lined-pipes and fittings is likely to increase. This trend is expected to drive market growth, as companies invest in compliant solutions to avoid penalties and enhance workplace safety.

Growing Demand for High Purity Applications

The fluoropolymer lined-pipes-fittings market is experiencing a surge in demand driven by the need for high purity applications, particularly in the pharmaceutical and semiconductor industries. These sectors require piping solutions that can maintain the integrity of sensitive materials and prevent contamination. Fluoropolymer lined products are ideal for such applications due to their non-reactive nature and ease of cleaning. As the pharmaceutical industry continues to expand, with an increasing number of drug formulations and manufacturing processes, the demand for high purity piping solutions is expected to rise. This trend indicates a potential market growth of around 7% in the coming years, as companies prioritize the use of fluoropolymer lined-pipes and fittings to ensure product quality and compliance.

Technological Innovations in Material Science

The fluoropolymer lined-pipes-fittings market is poised for growth due to ongoing technological innovations in material science. Advances in the development of new fluoropolymer materials are enhancing the performance characteristics of lined-pipes and fittings, making them more durable and versatile. Innovations such as improved bonding techniques and enhanced thermal stability are expanding the applications of these products in various sectors. As manufacturers continue to invest in research and development, the market is likely to see an influx of advanced solutions that cater to specific industry needs. This trend may lead to an increase in market share for fluoropolymer lined-pipes-fittings, as companies seek to leverage cutting-edge materials to improve their operational capabilities.