Rising Demand in Oil and Gas Sector

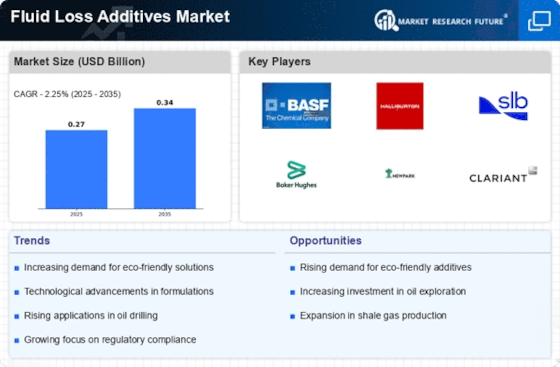

The Fluid Loss Additives Market is experiencing a notable surge in demand, primarily driven by the oil and gas sector. As exploration and production activities intensify, the need for effective fluid loss control becomes paramount. In 2025, the oil and gas industry is projected to account for a substantial share of the fluid loss additives market, with estimates suggesting a growth rate of approximately 5% annually. This growth is attributed to the increasing complexity of drilling operations, which necessitates the use of advanced additives to enhance performance and reduce fluid loss. Furthermore, the shift towards deeper and more challenging drilling environments amplifies the requirement for specialized fluid loss additives, thereby propelling market expansion.

Environmental Regulations and Compliance

The Fluid Loss Additives Market is significantly influenced by stringent environmental regulations aimed at minimizing the ecological impact of drilling fluids. As regulatory bodies enforce stricter guidelines, companies are compelled to adopt environmentally friendly additives that comply with these standards. This trend is expected to drive innovation within the fluid loss additives sector, as manufacturers develop sustainable solutions that meet regulatory requirements. In 2025, the market for eco-friendly fluid loss additives is anticipated to grow by approximately 6%, reflecting the industry's commitment to sustainability. Consequently, the demand for biodegradable and non-toxic additives is likely to increase, reshaping the competitive landscape of the fluid loss additives market.

Growing Focus on Enhanced Drilling Efficiency

The Fluid Loss Additives Market is increasingly driven by the need for enhanced drilling efficiency. As operators seek to optimize their drilling operations, the demand for additives that minimize fluid loss and improve overall performance is rising. In 2025, the market is projected to grow by approximately 5% as companies prioritize cost-effective solutions that enhance drilling efficiency. The integration of fluid loss additives into drilling fluids not only reduces operational costs but also improves the rate of penetration and overall productivity. This focus on efficiency is likely to shape the future landscape of the fluid loss additives market, as stakeholders seek innovative solutions to meet the challenges of modern drilling operations.

Technological Innovations in Additive Formulation

Technological advancements play a crucial role in shaping the Fluid Loss Additives Market. Innovations in additive formulation are leading to the development of more efficient and effective products that cater to the evolving needs of the drilling sector. In 2025, the introduction of smart additives, which can adapt to varying conditions during drilling, is expected to enhance fluid performance and reduce losses significantly. This technological evolution is projected to contribute to a market growth rate of around 4% annually. Moreover, the integration of digital technologies in additive formulation processes is likely to streamline production and improve product consistency, further bolstering the fluid loss additives market.

Increasing Exploration Activities in Emerging Markets

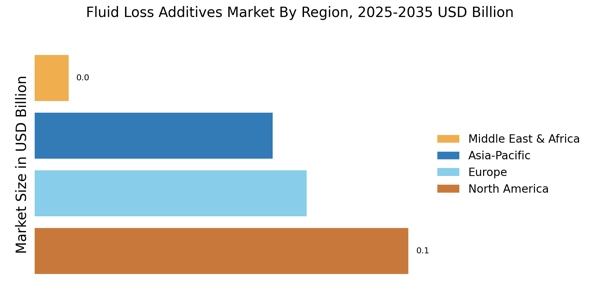

The Fluid Loss Additives Market is witnessing a shift in focus towards emerging markets, where exploration activities are on the rise. Countries in regions such as Asia-Pacific and Africa are investing heavily in oil and gas exploration, leading to an increased demand for fluid loss additives. In 2025, it is estimated that these emerging markets will contribute to nearly 30% of the overall market share, driven by the need for efficient drilling solutions. The influx of foreign investments and technological transfers in these regions is likely to enhance the adoption of advanced fluid loss additives, thereby propelling market growth. This trend indicates a promising future for the fluid loss additives market in these developing economies.