Top Industry Leaders in the Fluid Loss Additives Market

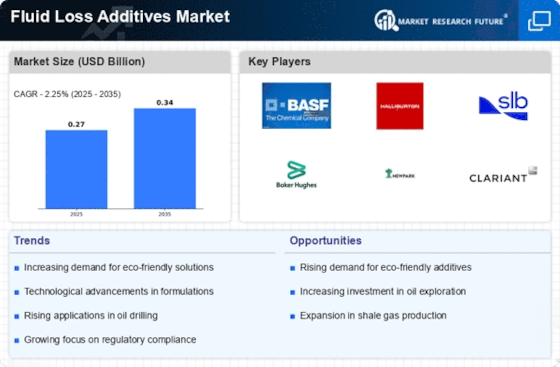

The fluid loss additives market, a crucial cog in the oil and gas industry's well-oiled machine, is expected to witness steady growth in the coming years. But amidst this promising outlook, a fierce competitive battle rages on.

Industry Titans and their Strategies:

The market boasts a diverse range of players, from established giants like Halliburton and Schlumberger to niche specialists like BASF and Clariant. Each player adopts unique strategies to carve out their niche:

-

Innovation Leaders: Companies like Halliburton and Chevron Phillips Chemical invest heavily in R&D, developing novel, high-performance additives tailored to specific drilling environments. -

Cost Champions: Players like SNF and National Oilwell Varco focus on cost-effective solutions, catering to budget-conscious operators in mature fields. -

Sustainability Advocates: Companies like Ecolab and Baker Hughes are rising to the challenge of developing environmentally friendly additives that comply with stricter regulations.

Factors Influencing Market Share:

Several factors influence a player's market share:

-

Product Portfolio: A diverse portfolio catering to various drilling needs and offering superior performance is key. -

Geographic Reach: Having a strong presence in key oil and gas regions like North America and the Middle East is crucial. -

Technical Expertise: Deep understanding of drilling fluids and wellbore challenges allows for customized solutions. -

Brand Reputation: A strong brand image built on reliability and quality attracts customers. -

Distribution Network: Efficient distribution channels ensure timely delivery to drilling sites.

Key Companies in the Fluid Loss Additives market include

- Halliburton (US)

- Schlumberger Limited (US)

- Newpark Resources Inc. (US)

- Solvay (Belgium)

- BASF SE (Germany)

- Clariant (Switzerland)

- Drilling Fluids And Chemicals Limited (India)

- Tytan Organics (India)

- Nouryon (Netherlands)

- SEPCOR INC (US)

- Kemira (Finland)

- Audin Group (UK)

Recent Developments:

February 2022: Kemira introduced biomass-balanced polyacrylamide polymer. The polymer is water soluble, making it appropriate for water-intensive industries such as paper and electricity.

May 2020: BASF SE, a leading chemical company, has indicated that it intends to begin its smart Verbund project in Zhanjiang, Guangdong. The initial factories would produce engineering plastics and thermoplastic polyurethane to address the growing demands of varied emerging industries in Southern China and throughout Asia.