Customization Demand

The Flexographic Printing Market is witnessing a notable increase in demand for customization and short-run printing. As brands seek to differentiate themselves in a crowded marketplace, the ability to produce tailored packaging and labels is becoming essential. Flexographic printing offers the flexibility to create unique designs and variations without incurring prohibitive costs. In 2025, it is anticipated that the share of customized products in the flexographic printing market will rise significantly, reflecting a broader trend towards personalization in consumer goods. This shift is particularly evident in sectors such as food and beverage, where packaging plays a crucial role in attracting consumers. The ability to quickly adapt to market trends and consumer preferences positions flexographic printing as a preferred choice for many businesses.

Growth in E-commerce

The rise of e-commerce is a driving force behind the Flexographic Printing Market. As online shopping continues to expand, the demand for packaging solutions that are both functional and visually appealing is increasing. Flexographic printing is well-suited for producing high-quality packaging that meets the needs of e-commerce businesses. In 2025, the e-commerce sector is expected to contribute significantly to the growth of the flexographic printing market, with projections indicating a potential increase in packaging demand by over 20%. This trend underscores the importance of efficient and attractive packaging in enhancing customer experience and brand loyalty. Companies that leverage flexographic printing for their e-commerce packaging are likely to gain a competitive edge.

Regulatory Compliance

Regulatory compliance is becoming increasingly important within the Flexographic Printing Market. As governments implement stricter regulations regarding packaging materials and waste management, companies are compelled to adapt their practices. Flexographic printing, with its ability to utilize eco-friendly inks and materials, positions itself favorably in this evolving landscape. In 2025, it is expected that compliance with environmental regulations will drive a substantial portion of the flexographic printing market, as businesses seek to avoid penalties and enhance their corporate social responsibility profiles. This focus on compliance not only influences operational practices but also shapes consumer perceptions, as brands that prioritize sustainability are often viewed more favorably. The ability to meet regulatory standards will likely be a key differentiator in the competitive flexographic printing landscape.

Technological Innovations

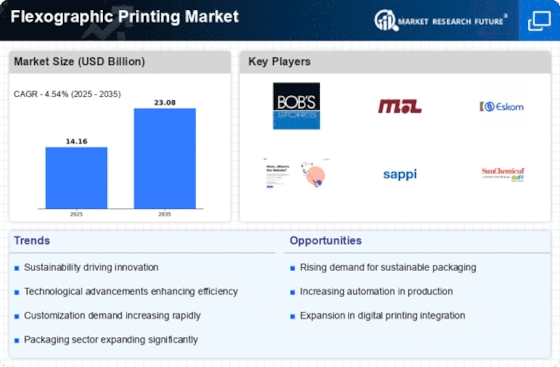

Technological advancements play a pivotal role in shaping the Flexographic Printing Market. Innovations such as digital flexo printing and improved plate-making technologies are enhancing print quality and efficiency. The integration of automation and smart technologies is streamlining production processes, reducing waste, and increasing output. In 2025, the market is projected to experience a compound annual growth rate (CAGR) of over 4%, driven by these technological improvements. Companies are investing in state-of-the-art equipment to meet the rising demand for high-quality prints at competitive prices. This focus on technology not only boosts productivity but also positions the flexographic printing sector as a leader in the printing industry.

Sustainability Initiatives

The Flexographic Printing Market is increasingly influenced by sustainability initiatives. As consumers and businesses alike prioritize eco-friendly practices, the demand for sustainable printing solutions has surged. Flexographic printing, known for its lower environmental impact compared to traditional methods, is gaining traction. The industry is witnessing a shift towards water-based inks and recyclable substrates, which align with the growing emphasis on reducing carbon footprints. In 2025, it is estimated that the market for sustainable printing solutions will account for a significant portion of the overall flexographic printing market, potentially reaching a valuation of several billion dollars. This trend not only reflects consumer preferences but also regulatory pressures that encourage environmentally responsible practices.