Flavor Market Summary

As per Market Research Future analysis, the Flavor Market was estimated at 17.2 USD Billion in 2024. The Flavor industry is projected to grow from USD 18.3 Billion in 2025 to USD 34.0 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Flavor Market is experiencing a dynamic shift towards natural and innovative offerings.

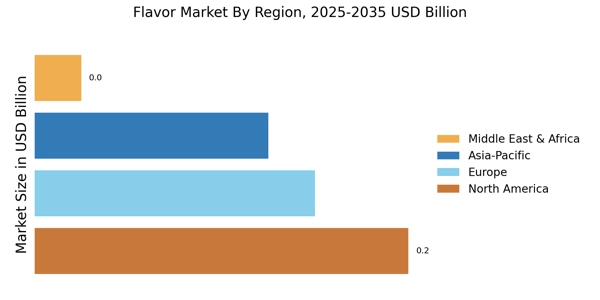

- The North American region remains the largest market for flavors, driven by a growing demand for natural ingredients.

- In contrast, the Asia-Pacific region is the fastest-growing market, fueled by increasing culinary exploration and diverse consumer preferences.

- Natural flavors dominate the market, while synthetic flavors are rapidly gaining traction due to their cost-effectiveness and versatility.

- Health consciousness and sustainability initiatives are key drivers influencing the flavor market's evolution.

Market Size & Forecast

| 2024 Market Size | 17.2 (USD Billion) |

| 2035 Market Size | 34.0 (USD Billion) |

| CAGR (2025 - 2035) | 6.40% |

Major Players

Givaudan (CH), Firmenich (CH), International Flavors & Fragrances (US), Symrise (DE), T. Hasegawa (JP), Sensient Technologies (US), Mane (FR), Robertet (FR), Kerry Group (IE)