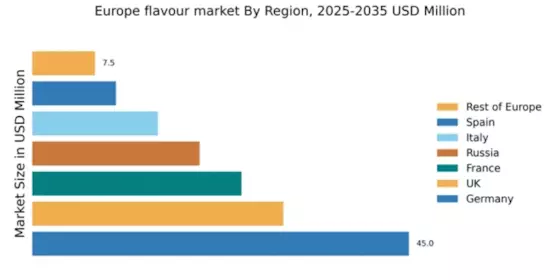

Germany : Strong Demand and Innovation Drive Success

Germany holds a commanding 45.0% market share in the European flavour market, valued at approximately €1.5 billion. Key growth drivers include a robust food and beverage sector, increasing consumer preference for natural flavours, and stringent regulatory standards promoting quality. Government initiatives supporting sustainable practices and innovation in flavour technology further enhance market dynamics. The country’s advanced infrastructure and industrial capabilities facilitate efficient production and distribution.

UK : Culinary Innovation Fuels Demand

Key markets include London, Manchester, and Birmingham, where a vibrant food scene fosters competition. Major players like Givaudan and Firmenich have established significant operations, enhancing local supply chains. The competitive landscape is characterized by innovation, with companies investing in R&D to meet evolving consumer preferences. The beverage sector, particularly craft beers and spirits, is a notable application area.

France : Culinary Heritage Meets Modern Trends

Key cities like Paris, Lyon, and Marseille are central to the flavour market, with a competitive landscape featuring major players such as Mane and Robertet. The local business environment is dynamic, with a focus on high-quality ingredients and unique flavour combinations. The food service industry, particularly fine dining and gourmet retail, represents significant applications for flavour products.

Russia : Emerging Trends and Local Preferences

Moscow and St. Petersburg are pivotal markets, showcasing a competitive landscape with both local and international players. Companies like Symrise and International Flavors & Fragrances have established a strong presence. The local market dynamics are influenced by consumer preferences for familiar and traditional flavours, while the beverage sector, particularly soft drinks and spirits, is a significant application area.

Italy : Culinary Excellence Drives Demand

Key markets include Milan, Rome, and Naples, where a competitive landscape features major players like Givaudan and Firmenich. The local business environment is characterized by a focus on high-quality ingredients and artisanal production methods. The food and beverage sector, particularly pasta, sauces, and wines, represents significant applications for flavour products.

Spain : Cultural Diversity Fuels Innovation

Key markets include Barcelona, Madrid, and Valencia, where a competitive landscape features both local and international players. Companies like Sensient Technologies and Mane have established a presence, contributing to local supply chains. The local market dynamics are influenced by consumer preferences for unique and diverse flavours, with the food service industry, particularly tapas and beverages, representing significant applications.

Rest of Europe : Diverse Opportunities Across Regions

Key markets include countries like Belgium, Netherlands, and Switzerland, where a competitive landscape features both local and international players. Companies like Kerry Group and T. Hasegawa have established operations, contributing to local supply chains. The local market dynamics are characterized by a focus on premium and artisanal products, with the food and beverage sector representing significant applications.