Rising Construction Activities

The Fire Protection System Pipes Market is experiencing growth due to the rising construction activities across various sectors. As urbanization continues to expand, there is a notable increase in the construction of commercial, residential, and industrial buildings. This surge in construction necessitates the installation of effective fire protection systems, including pipes, to safeguard lives and property. According to recent data, the construction sector is expected to witness a compound annual growth rate of approximately 5% over the next few years. Consequently, this growth in construction activities is likely to drive the demand for fire protection system pipes, as builders and developers prioritize safety measures in their projects.

Increased Awareness of Fire Safety

Increased awareness of fire safety among businesses and homeowners is a significant driver for the Fire Protection System Pipes Market. As incidents of fire-related disasters continue to make headlines, there is a growing recognition of the importance of effective fire protection measures. This heightened awareness is prompting organizations and individuals to invest in comprehensive fire safety systems, including the installation of reliable fire protection pipes. Educational campaigns and training programs are further contributing to this trend, as they emphasize the necessity of proper fire safety protocols. Consequently, the demand for fire protection system pipes is expected to rise as more stakeholders prioritize safety and compliance in their operations.

Regulatory Compliance and Safety Standards

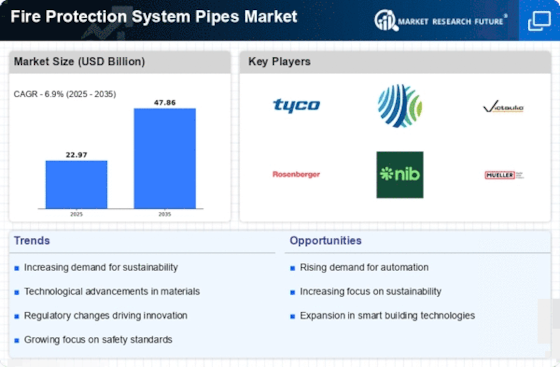

The Fire Protection System Pipes Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies enforce various codes and standards to ensure fire safety in buildings and infrastructure. These regulations often mandate the installation of fire protection systems, including pipes, to mitigate fire hazards. As a result, manufacturers and contractors are compelled to adhere to these regulations, driving demand for compliant fire protection system pipes. The market is projected to grow as more jurisdictions adopt and enforce these safety standards, leading to an increased focus on high-quality materials and installation practices. This trend not only enhances safety but also fosters innovation in pipe manufacturing, as companies strive to meet evolving regulatory requirements.

Emerging Markets and Infrastructure Development

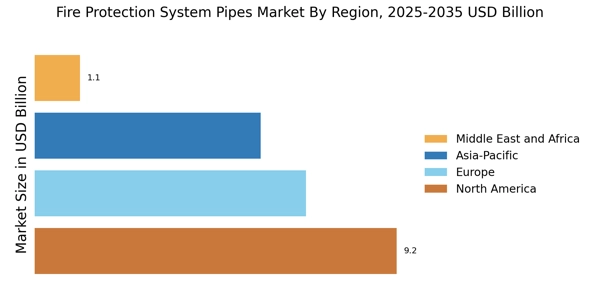

Emerging markets are witnessing rapid infrastructure development, which is significantly impacting the Fire Protection System Pipes Market. Countries undergoing economic growth are investing heavily in infrastructure projects, including transportation, healthcare, and commercial facilities. This investment often includes the implementation of fire protection systems to ensure safety and compliance with international standards. As these markets expand, the demand for fire protection system pipes is likely to increase, driven by the need for reliable and effective fire safety solutions. Furthermore, partnerships between local governments and international firms may facilitate the introduction of advanced fire protection technologies, further enhancing market prospects in these regions.

Technological Innovations in Pipe Manufacturing

Technological innovations in pipe manufacturing are playing a pivotal role in shaping the Fire Protection System Pipes Market. Advancements in materials science and manufacturing processes have led to the development of more durable, lightweight, and corrosion-resistant pipes. These innovations not only enhance the performance of fire protection systems but also reduce installation and maintenance costs. For instance, the introduction of advanced polymer materials has improved the flexibility and longevity of fire protection pipes. As manufacturers continue to invest in research and development, the market is likely to see a proliferation of innovative products that meet the diverse needs of various applications, thereby driving overall market growth.