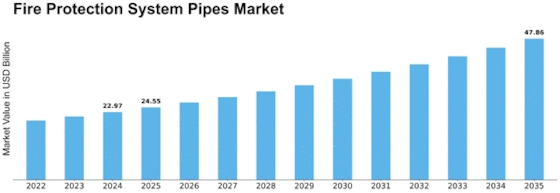

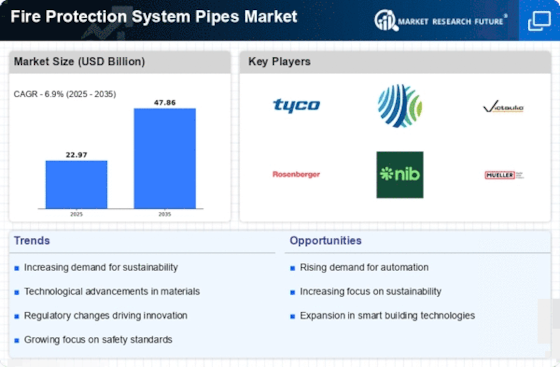

Fire Protection System Pipes Size

Fire Protection System Pipes Market Growth Projections and Opportunities

The fire protection system pipes market is stimulated by various factors that together define its dynamics, impacting the call for technological improvements and basic growth inside the industry. The call for fire protection system pipes is closely connected to stringent building codes and regulations that mandate the installation of fire suppression structures. As protection requirements evolve, the marketplace for compliant fire protection system pipes expands. The production and infrastructure sectors play a pivotal position in using the fire protection system pipes marketplace. Increasing investments in commercial and home production tasks, alongside infrastructure development, contribute to the call for hearth protection structures and associated pipes. Urbanization trends, especially the boom of high-upward push homes and dense city areas, pressure the demand for effective fire safety systems. The installation of fire protection system pipes will become important in ensuring the safety of occupants and complying with building policies. Ongoing technological advancements in pipe substances impact marketplace dynamics. Innovations in the layout and materials of fire protection system pipes, which include the use of corrosion-resistant alloys and composite materials, contribute to greater overall performance and sturdiness. Increased recognition of hearth dangers and industry education contribute to the call for sturdy hearth protection structures. Market dynamics are influenced by corporations and individuals seeking to enhance fireplace protection measures, driving the adoption of superior fire protection system pipes. The expansion of industrial and commercial sectors, including production centers, warehouses, and facts centers, contributes to the call for fire protection system pipes. These sectors prioritize fireplace protection to defend assets, employees, and operations. Government tasks selling hearth safety and offering investment for infrastructure development impact the fire protection system pipes marketplace. Policies that incentivize the installation of fire safety structures make contributions to market growth. Upgradation and retrofitting tasks in current buildings and centers pressure the call for fire protection system pipes. As older structures are renovated to satisfy current safety standards, there's a need for updated fireplace protection structures, influencing marketplace tendencies. Compliance with enterprise standards and certifications is an essential component in the fire protection system pipes marketplace. Contractors, architects, and constructing owners decide upon pipes that meet identified standards for hearth protection systems.

Leave a Comment