Rising Demand for Financial Literacy Tools

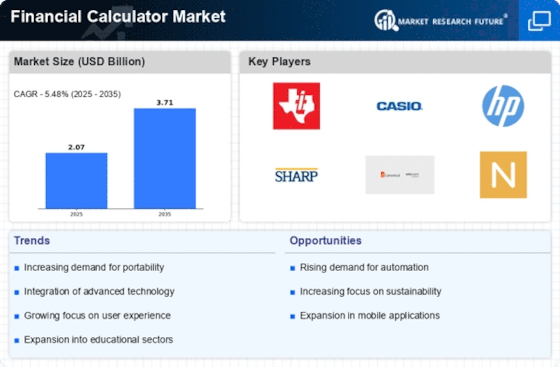

The increasing emphasis on financial literacy across various demographics appears to be a primary driver for the Financial Calculator Market. Educational institutions and organizations are actively promoting financial education, leading to a heightened demand for tools that facilitate understanding of complex financial concepts. This trend is reflected in the growing number of financial literacy programs, which often incorporate calculators as essential learning aids. As individuals seek to enhance their financial decision-making skills, the market for financial calculators is likely to expand. Reports indicate that the financial literacy market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, further underscoring the potential for financial calculators to play a pivotal role in this educational landscape.

Technological Advancements in Financial Tools

Technological innovations are reshaping the Financial Calculator Market, as advancements in software and hardware enhance the functionality and accessibility of financial calculators. The integration of artificial intelligence and machine learning algorithms into financial calculators allows for more personalized and accurate financial analysis. Furthermore, the proliferation of mobile applications has made financial calculators more accessible to a broader audience. According to recent data, the mobile application segment of the financial tools market is expected to witness a growth rate of over 15% annually. This trend suggests that as technology continues to evolve, the Financial Calculator Market will likely experience significant growth driven by enhanced user experiences and capabilities.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements in various financial sectors are driving the demand for sophisticated financial calculators within the Financial Calculator Market. As businesses and individuals navigate complex financial regulations, the need for accurate calculations and projections becomes paramount. Financial calculators that can accommodate various regulatory frameworks are increasingly sought after, as they provide users with the necessary tools to ensure compliance. This trend is particularly evident in sectors such as banking and investment, where adherence to regulations is critical. The market for compliance-related financial tools is expected to grow, indicating a potential increase in the demand for calculators that can assist users in meeting these requirements.

Growing E-commerce and Online Financial Services

The rise of e-commerce and online financial services is significantly impacting the Financial Calculator Market. As more consumers engage in online banking, investing, and financial planning, the need for accessible and efficient financial calculators has surged. E-commerce platforms are increasingly integrating financial calculators into their services to enhance user experience and facilitate informed decision-making. Data suggests that the online financial services market is expected to grow at a compound annual growth rate of around 12% over the next few years. This growth indicates a robust opportunity for financial calculators to become integral tools within the online financial ecosystem, catering to the evolving needs of tech-savvy consumers.

Increased Adoption of Financial Planning Services

The growing trend of individuals and businesses seeking professional financial planning services is contributing to the expansion of the Financial Calculator Market. As more people recognize the importance of strategic financial management, the demand for calculators that assist in budgeting, investment analysis, and retirement planning is on the rise. Financial planners often utilize these tools to provide clients with accurate projections and analyses, thereby enhancing the overall service offering. Market data indicates that the financial planning services sector is projected to grow at a rate of approximately 8% annually, which may lead to increased sales of financial calculators as essential tools for both professionals and their clients.