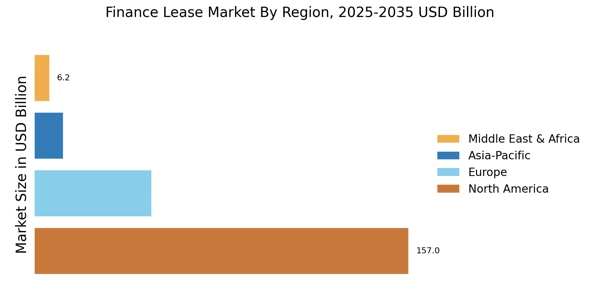

North America : Leading Finance Lease Market

The North American finance lease market is driven by robust economic growth, technological advancements, and increasing demand for flexible financing solutions. The United States holds the largest market share at approximately 70%, followed by Canada at around 15%. Regulatory support for leasing as a financing option further catalyzes market expansion, with favorable tax treatments and incentives for businesses adopting leasing solutions. In this region, the competitive landscape is dominated by key players such as CIT Group Inc. and DLL, which offer a wide range of leasing solutions across various sectors. The presence of established financial institutions and a growing trend towards digital leasing platforms are enhancing market dynamics. As businesses increasingly seek to optimize their capital expenditures, the finance lease market is expected to continue its upward trajectory in North America.

Europe : Diverse and Evolving Market

The European finance lease market is characterized by its diversity and evolving regulatory framework, which promotes sustainable financing solutions. Germany and France are the largest markets, holding approximately 30% and 25% market shares, respectively. The European Union's initiatives to enhance financial transparency and support green financing are significant growth drivers, encouraging businesses to adopt leasing as a viable financing option. Leading countries in this region include Germany, France, and the Netherlands, with major players like Deutsche Leasing AG and BNP Paribas Leasing Solutions. The competitive landscape is marked by a mix of traditional banks and specialized leasing companies, fostering innovation in service offerings. As businesses increasingly prioritize sustainability, the finance lease market in Europe is adapting to meet these changing demands, positioning itself for future growth.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific finance lease market is witnessing rapid growth, driven by increasing industrialization, urbanization, and a rising demand for capital-intensive equipment. China and Japan are the largest markets, accounting for approximately 40% and 20% of the market share, respectively. Government initiatives aimed at boosting infrastructure development and manufacturing capabilities are significant catalysts for market expansion, creating a favorable environment for finance leasing. In this region, key players such as Hitachi Capital Corporation and Mitsubishi UFJ Lease & Finance Company Limited are leading the charge, offering innovative leasing solutions tailored to local market needs. The competitive landscape is evolving, with a growing number of domestic players entering the market, enhancing competition and service diversity. As businesses seek to optimize their asset utilization, the finance lease market in Asia-Pacific is poised for substantial growth in the coming years.

Middle East and Africa : Growing Financial Solutions Market

The finance lease market in the Middle East and Africa is gradually expanding, driven by increasing economic diversification and infrastructure development initiatives. The United Arab Emirates and South Africa are the largest markets, holding approximately 25% and 20% market shares, respectively. Regulatory frameworks are evolving to support leasing as a financing option, with governments recognizing its potential to stimulate economic growth and attract foreign investment. Key players in this region include local and international firms, with a growing presence of companies offering tailored leasing solutions. The competitive landscape is characterized by a mix of established financial institutions and emerging players, fostering innovation and service enhancement. As the region continues to develop, the finance lease market is expected to gain traction, driven by increasing demand for flexible financing solutions.