Regulatory Support and Standards

Regulatory frameworks and standards are playing a crucial role in the Global Fiber-Reinforced Plastic Grating Market Industry. Governments worldwide are increasingly implementing regulations that promote the use of advanced materials in construction and industrial applications. These regulations often emphasize safety, durability, and environmental impact, thereby encouraging industries to adopt fiber-reinforced plastic grating. For example, compliance with safety standards in hazardous environments drives the demand for this type of grating. As regulatory support continues to strengthen, it is expected to further bolster market growth and adoption across various sectors.

Rising Infrastructure Development

The Global Fiber-Reinforced Plastic Grating Market Industry is poised for growth due to the rising infrastructure development across the globe. As countries invest in modernizing their infrastructure, the demand for durable and lightweight materials like fiber-reinforced plastic grating is increasing. This material is particularly favored in pedestrian walkways, bridges, and industrial flooring due to its strength and resistance to environmental factors. The ongoing global initiatives to enhance infrastructure are likely to contribute to the market's expansion, providing opportunities for manufacturers and suppliers to capitalize on this upward trend.

Growing Demand in Industrial Applications

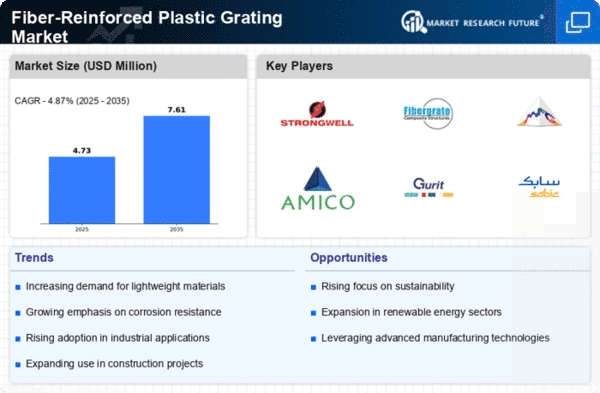

The Global Fiber-Reinforced Plastic Grating Market Industry is experiencing a surge in demand driven by its extensive applications in various industrial sectors. Industries such as oil and gas, chemical processing, and wastewater treatment are increasingly adopting fiber-reinforced plastic grating due to its corrosion resistance and lightweight properties. For instance, in the oil and gas sector, the use of this grating enhances safety and operational efficiency, as it can withstand harsh environments. The market is projected to reach 681.7 USD Million in 2024, reflecting the growing reliance on advanced materials that offer durability and safety in industrial settings.

Technological Advancements in Manufacturing

Technological advancements are significantly shaping the Global Fiber-Reinforced Plastic Grating Market Industry. Innovations in manufacturing processes, such as improved resin formulations and automated production techniques, enhance the performance and reduce the costs of fiber-reinforced plastic grating. These advancements not only improve the mechanical properties of the grating but also expand its application range across various sectors, including construction and marine environments. As a result, the market is likely to witness a steady growth rate, with a projected CAGR of 1.31% from 2025 to 2035, reflecting the ongoing evolution of production technologies.

Sustainability and Environmental Considerations

Sustainability is becoming a pivotal factor influencing the Global Fiber-Reinforced Plastic Grating Market Industry. As industries strive to reduce their carbon footprint, the demand for eco-friendly materials is on the rise. Fiber-reinforced plastic grating, being recyclable and requiring less energy for production compared to traditional materials, aligns with these sustainability goals. This shift is particularly evident in construction and infrastructure projects, where environmentally conscious choices are prioritized. The anticipated growth in this market segment suggests that by 2035, the market could reach 786.2 USD Million, indicating a robust trend towards sustainable industrial practices.