Top Industry Leaders in the Fermentation Chemicals Market

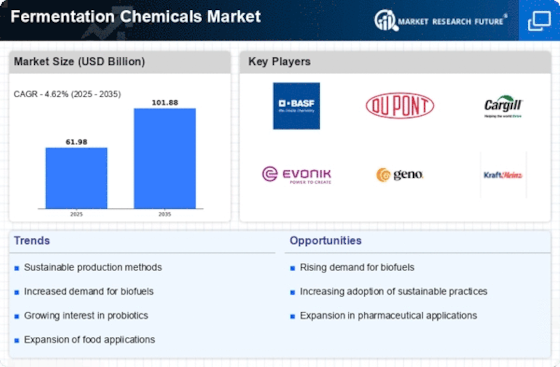

The fermentation chemicals market, where microscopic catalysts orchestrate chemical transformations like a microscopic symphony, is bubbling with competition. These chemicals, vital for producing a vast array of products from biofuels to food additives, drive a multi-billion dollar industry marked by dynamic strategies, evolving trends, and fierce rivalries. Let's delve into this effervescent landscape, exploring the strategies, market share determinants, industry news, and recent developments shaping its trajectory.

Strategies Fermenting Market Share:

Diversification and Specialization: Leading players like Novozymes A/S and Chr. Hansen A/S are expanding their portfolios beyond traditional enzymes, offering customized blends and novel biocatalysts for specific applications like biopharmaceuticals or bioplastics. Meanwhile, niche players like Amano Enzymes Inc. are carving out unique positions by specializing in high-purity enzymes or rare microbial strains.

Technological Prowess: Innovation is the key ingredient. Companies like DSM and BASF SE are pouring resources into R&D, developing enzyme engineering techniques, fermentation optimization platforms, and artificial intelligence-powered strain screening tools to create more efficient and effective biocatalysts.

Sustainability Focus: Eco-friendliness is the rising tide. Companies like Evonik Industries AG and Archer Daniels Midland are leading the charge with bio-based fermentations, renewable feedstocks, and energy-efficient processes, appealing to environmentally conscious consumers and gaining regulatory advantage.

Geographical Expansion: Emerging markets are the fertile ground. Companies like Ajinomoto Co. Inc. and Cargill Incorporated are aggressively expanding their footprints in Asia and Latin America, capitalizing on the burgeoning demand for bio-based chemicals in these regions.

Strategic Partnerships and Acquisitions: Collaboration is the catalyst for growth. Recent examples include Chr. Hansen A/S's partnership with a leading food manufacturer to develop novel probiotic cultures and BASF SE's acquisition of a bioplastics producer, strengthening their positions in high-growth segments.

Factors Shaking the Fermentation Flask:

Product Performance: Efficiency, specificity, and robustness of the fermentation chemicals determine their value proposition. Enzymes capable of higher yields, faster conversions, and broader substrate range hold the key to market share.

Cost Competitiveness: Efficient production processes, optimized supply chains, and access to low-cost feedstocks play a crucial role in winning price-sensitive contracts, especially in bulk commodity applications.

Regulatory Landscape: Safety and environmental regulations can disrupt the market. Stringent approval processes and stricter emission standards require players to adapt and innovate to comply.

Upstream and Downstream Integration: Integrating into the supply chain for feedstocks or finished products can offer cost advantages and control over quality. However, it also requires significant capital investment and operational complexity.

Demand Trends: Rising demand for biofuels, bioplastics, and functional food ingredients fueled by environmental concerns and changing consumer preferences are driving market growth.

Key Companies in the Fermentation Chemicals market include

-

AB Enzymes (Germany)

-

Amano Enzyme Inc. (Japan)

-

Evonik Industries AG (Germany)

-

Koninklijke DSM N.V. (The Netherlands)

-

EUROSANEX (Spain)

-

Cargill Incorporated (US)

-

Archer Daniels Midland Company(US)

-

BASF SE (Germany)

-

Ajinomoto Co. Inc. (Japan)

-

Novozymes (Denmark)

-

Chr. Hansen Holding A/S (Denmark)

-

INVISTA (US)

-

DowDuPont (US)

Recent Developments:

September 2023: The US implements tax breaks for biofuel production, boosting demand for fermentation chemicals in the bioenergy sector.

October 2023: China announces stricter environmental regulations for fermentation processes, impacting production costs and forcing companies to adopt cleaner technologies.

December 2023: The global fermentation chemicals market shows signs of continued growth, driven by increasing demand for bio-based products and ongoing research and development initiatives.