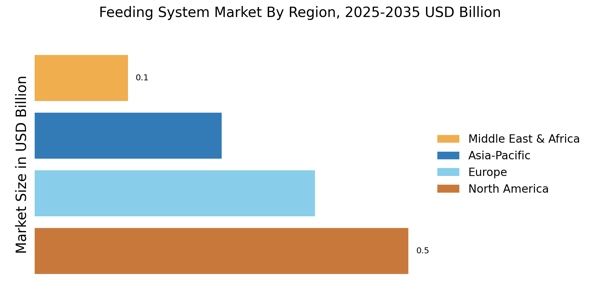

North America : Technological Innovation Leader

North America is the largest market for feeding systems, holding approximately 40% of the global share. The region's growth is driven by advancements in agricultural technology, increasing demand for automation, and supportive government policies promoting sustainable farming practices. Regulatory frameworks are evolving to enhance food safety and animal welfare, further boosting market demand. The United States and Canada are the leading countries in this market, with significant investments in research and development. Key players like DeLaval, GSI, and BouMatic are at the forefront, offering innovative solutions that cater to the needs of modern farms. The competitive landscape is characterized by a mix of established companies and emerging startups, all striving to enhance efficiency and productivity in feeding systems.

Europe : Sustainable Agriculture Focus

Europe is the second-largest market for feeding systems, accounting for around 30% of the global market share. The region's growth is fueled by a strong emphasis on sustainable agriculture, regulatory support for eco-friendly practices, and increasing consumer demand for high-quality food products. The European Union's Common Agricultural Policy plays a crucial role in shaping market dynamics, promoting innovation and efficiency in farming. Leading countries in this region include Germany, France, and the Netherlands, where companies like Tetra Laval and Big Dutchman are prominent. The competitive landscape is marked by a focus on technological advancements and sustainability, with many firms investing in research to develop smarter feeding solutions. The presence of key players ensures a robust market environment, driving continuous improvement in feeding systems.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the feeding system market, holding approximately 20% of the global share. The region's expansion is driven by increasing livestock production, rising disposable incomes, and a growing population demanding higher food quality. Government initiatives aimed at modernizing agriculture and enhancing food security are also significant growth catalysts, fostering a favorable regulatory environment. Countries like China, India, and Australia are leading the charge, with a mix of local and international players competing for market share. Companies such as Lely and Petersime are making strides in this region, focusing on innovative feeding solutions tailored to local needs. The competitive landscape is evolving, with an increasing number of startups entering the market, contributing to a dynamic and diverse ecosystem.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa represent an emerging market for feeding systems, accounting for about 10% of the global share. The region's growth is driven by increasing investments in agriculture, a rising population, and the need for improved food security. Governments are implementing policies to enhance agricultural productivity, which is creating a favorable environment for feeding system adoption. Leading countries in this region include South Africa, Egypt, and the UAE, where there is a growing interest in modern farming techniques. The competitive landscape features both local and international players, with companies like Farming Technologies and HerdStar making significant contributions. The market is characterized by a focus on innovation and sustainability, as stakeholders seek to address the challenges of food production in a resource-constrained environment.