Market Growth Projections

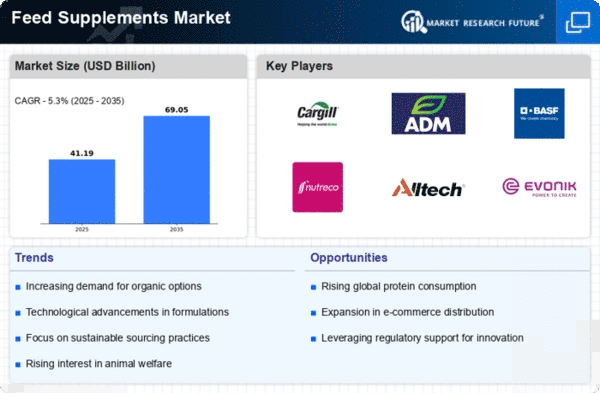

The Global Feed Supplements Market Industry is poised for substantial growth, with projections indicating a market value of 39.1 USD Billion in 2024 and an anticipated increase to 69.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.3% from 2025 to 2035, reflecting the industry's resilience and adaptability. Factors such as rising demand for animal protein, technological advancements, and regulatory support are likely to drive this expansion. The market's evolution will be characterized by innovations in feed formulations and a focus on sustainability, positioning it as a key player in the global agricultural landscape.

Consumer Awareness and Education

Increasing consumer awareness regarding the nutritional benefits of feed supplements is influencing the Global Feed Supplements Market Industry. As consumers become more informed about the role of feed supplements in enhancing animal health and productivity, demand is likely to rise. Educational initiatives by industry stakeholders are crucial in promoting the advantages of these products. This heightened awareness could lead to a shift in purchasing behaviors, with consumers favoring products that prioritize animal welfare and health. Consequently, the market may experience substantial growth, aligning with the overall trend of increasing investment in quality feed supplements.

Rising Demand for Animal Protein

The Global Feed Supplements Market Industry experiences a surge in demand for animal protein, driven by increasing global population and changing dietary preferences. As consumers shift towards protein-rich diets, the need for efficient livestock production intensifies. This trend is reflected in the projected market value of 39.1 USD Billion in 2024, indicating a robust growth trajectory. Feed supplements play a crucial role in enhancing feed efficiency and overall animal health, thereby supporting the livestock sector in meeting the rising protein demands. The industry is likely to witness innovations in feed formulations to cater to diverse nutritional requirements.

Focus on Animal Health and Welfare

There is a growing emphasis on animal health and welfare within the Global Feed Supplements Market Industry. Stakeholders are increasingly aware of the importance of maintaining livestock health to ensure productivity and sustainability. This focus is likely to drive the adoption of feed supplements that promote gut health, immune function, and overall well-being. As consumers become more conscious of animal welfare, the demand for high-quality feed supplements is expected to rise. This trend aligns with the projected market growth, potentially reaching 69.0 USD Billion by 2035, as producers seek to enhance animal health through innovative supplement solutions.

Regulatory Support for Feed Quality

Regulatory frameworks supporting feed quality and safety are pivotal in shaping the Global Feed Supplements Market Industry. Governments worldwide are implementing stringent regulations to ensure that feed supplements meet safety and efficacy standards. This regulatory support fosters consumer confidence and encourages the adoption of high-quality feed products. As a result, manufacturers are likely to invest in research and development to comply with these regulations, leading to enhanced product offerings. The anticipated compound annual growth rate of 5.3% from 2025 to 2035 underscores the potential for growth in this sector, driven by regulatory compliance and quality assurance.

Technological Advancements in Feed Production

Technological advancements are transforming the Global Feed Supplements Market Industry, enabling more efficient and sustainable feed production. Innovations such as precision nutrition, fermentation technology and alternative protein sources are gaining traction. These advancements not only improve feed efficiency but also reduce environmental impacts associated with livestock farming. As producers seek to optimize feed formulations, the integration of technology is likely to enhance the overall quality of feed supplements. This trend is expected to contribute to the market's growth, with projections indicating a significant increase in value as the industry adapts to evolving technological landscapes.