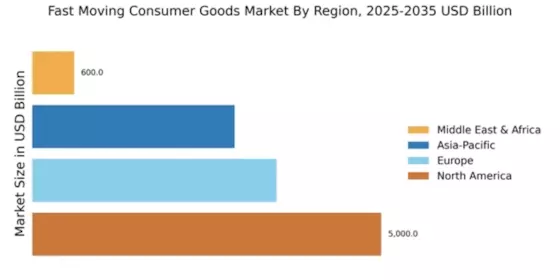

North America : Market Leader in FMCG

North America continues to lead the Fast Moving Consumer Goods (FMCG) market, holding a significant share of 5000.0. The region's growth is driven by a robust economy, high consumer spending, and a strong retail infrastructure. Regulatory support for innovation and sustainability initiatives further fuels demand, as consumers increasingly seek eco-friendly products. The market is expected to maintain its momentum as e-commerce and digital marketing strategies evolve, catering to changing consumer preferences. The competitive landscape in North America is characterized by the presence of major players such as Procter & Gamble, Coca-Cola, and PepsiCo. These companies leverage advanced supply chain management and marketing strategies to capture market share. The U.S. remains the largest market, followed by Canada and Mexico, with a growing emphasis on health-conscious and organic products. The ongoing trend towards convenience and online shopping is reshaping the FMCG sector, making it essential for companies to adapt swiftly to consumer demands.

Europe : Diverse and Competitive Market

Europe's FMCG market, valued at 3500.0, is characterized by diverse consumer preferences and a competitive landscape. The region benefits from strong regulatory frameworks that promote food safety and sustainability, driving demand for organic and locally sourced products. The rise of e-commerce and digital retailing has also transformed shopping habits, with consumers increasingly favoring online platforms for convenience. As sustainability becomes a priority, companies are innovating to meet eco-friendly standards, enhancing market growth. Leading countries in Europe include Germany, France, and the UK, where major players like Unilever and Nestle dominate the market. The competitive environment is marked by a mix of global giants and local brands, each vying for consumer loyalty. The emphasis on health and wellness products is reshaping the product offerings, with a notable increase in demand for plant-based and organic options. As the market evolves, companies must remain agile to adapt to changing consumer trends and regulatory requirements.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 2900.0, is witnessing rapid growth in the FMCG sector, driven by urbanization, rising disposable incomes, and changing consumer lifestyles. The demand for convenience products is on the rise, as busy urban populations seek quick and easy solutions. Regulatory frameworks are evolving to support product safety and quality, which is crucial for building consumer trust in emerging markets. The region's growth is further supported by the expansion of e-commerce platforms, making products more accessible to consumers. Key players in the Asia-Pacific market include multinational corporations like Nestle and local brands that cater to regional tastes. Countries such as China, India, and Japan are leading the charge, with significant investments in marketing and distribution channels. The competitive landscape is dynamic, with companies focusing on innovation and localization to meet diverse consumer needs. As the market matures, the emphasis on health and wellness products is expected to grow, shaping future trends in the FMCG sector.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region, valued at 600.0, presents untapped opportunities in the FMCG market. The growth is driven by a young population, increasing urbanization, and rising disposable incomes. Regulatory bodies are working to enhance food safety standards, which is crucial for consumer confidence. The demand for diverse product offerings is growing, particularly in urban areas where consumers are seeking quality and convenience. E-commerce is also gaining traction, providing new avenues for market expansion. Leading countries in the MEA region include South Africa, Nigeria, and the UAE, where both local and international brands are competing for market share. Key players like Coca-Cola and Unilever are investing in the region to capitalize on its growth potential. The competitive landscape is evolving, with a focus on adapting products to meet local tastes and preferences. As the market develops, companies must navigate regulatory challenges while leveraging opportunities for innovation and expansion.