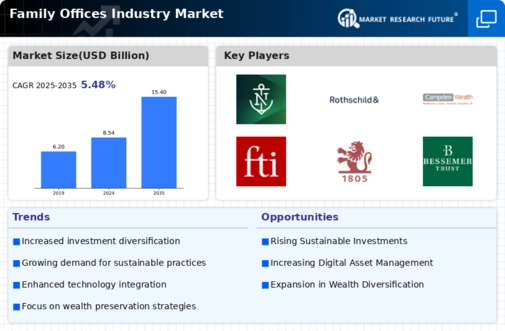

Growing Wealth Concentration

The Family Offices Industry Market appears to be significantly influenced by the increasing concentration of wealth among high-net-worth individuals. As wealth becomes more concentrated, the demand for personalized financial management services rises. In recent years, the number of ultra-high-net-worth individuals has surged, with estimates suggesting that there are over 200,000 individuals globally with assets exceeding 30 million USD. This trend indicates a robust growth potential for family offices, as they provide tailored investment strategies and wealth preservation solutions. Furthermore, the Family Offices Industry Market is likely to expand as these wealthy individuals seek to diversify their portfolios and engage in complex financial planning, thereby driving the demand for family office services.

Increased Regulatory Scrutiny

The Family Offices Industry Market is currently navigating a landscape of heightened regulatory scrutiny. Governments are increasingly focusing on transparency and compliance, particularly concerning tax regulations and anti-money laundering measures. This trend is prompting family offices to adopt more rigorous compliance frameworks to mitigate risks associated with regulatory changes. For instance, recent regulations in various jurisdictions require family offices to disclose more information about their operations and investments. As a result, the Family Offices Industry Market may witness a shift towards more structured governance practices, which could enhance the credibility and trustworthiness of family offices in the eyes of clients and regulators alike.

Rising Interest in Impact Investing

The Family Offices Industry Market is increasingly shaped by the growing interest in impact investing among affluent families. Many family offices are now prioritizing investments that not only yield financial returns but also generate positive social and environmental impacts. This shift is evidenced by a report indicating that impact investments could reach 1 trillion USD by 2025. Family offices are uniquely positioned to lead this trend, as they often have the flexibility to invest in innovative sectors such as renewable energy and social enterprises. As a result, the Family Offices Industry Market is likely to see a rise in demand for advisory services that align investment strategies with the values and missions of wealthy families.

Demand for Succession Planning Services

The Family Offices Industry Market is experiencing a growing demand for succession planning services as wealthy families seek to ensure the longevity of their wealth across generations. With an increasing number of family businesses facing the challenge of transitioning leadership, family offices are stepping in to provide strategic guidance. Research indicates that nearly 70% of family businesses do not survive the transition to the second generation, highlighting the critical need for effective succession planning. Family offices are uniquely equipped to address these challenges by offering tailored solutions that encompass estate planning, tax strategies, and family governance. This trend suggests that the Family Offices Industry Market will continue to expand as families prioritize the preservation of their legacies.

Technological Advancements in Wealth Management

Technological advancements are reshaping the Family Offices Industry Market, as family offices increasingly adopt digital tools to enhance their operations. The integration of artificial intelligence, data analytics, and blockchain technology is streamlining investment processes and improving decision-making. A recent survey indicates that over 60% of family offices are investing in technology to optimize their investment strategies. This trend not only enhances efficiency but also allows family offices to offer more sophisticated services to their clients. As technology continues to evolve, the Family Offices Industry Market is expected to experience significant transformation, with firms that embrace innovation likely to gain a competitive edge.