Emergence of ESG Investing

The Investment Management Software Market is experiencing a notable shift towards Environmental, Social, and Governance (ESG) investing. As investors increasingly prioritize sustainability, investment firms are seeking software solutions that can effectively integrate ESG criteria into their investment strategies. Recent data suggests that assets under management in ESG-focused funds have surged, indicating a growing market segment. This trend is prompting software providers to develop tools that facilitate ESG analysis and reporting. Investment management software that supports ESG integration is likely to become essential for firms aiming to attract socially conscious investors and align with evolving market expectations.

Growing Regulatory Pressures

The Investment Management Software Market is increasingly influenced by growing regulatory pressures. As regulatory frameworks evolve, investment firms are compelled to adopt software solutions that ensure compliance with various standards. Recent reports indicate that compliance-related costs for investment firms have risen significantly, prompting a shift towards software that can automate compliance processes. This trend is likely to drive the demand for investment management software that incorporates compliance features, such as reporting and risk management tools. Firms that proactively address regulatory requirements through advanced software solutions may gain a competitive edge, as they can mitigate risks associated with non-compliance.

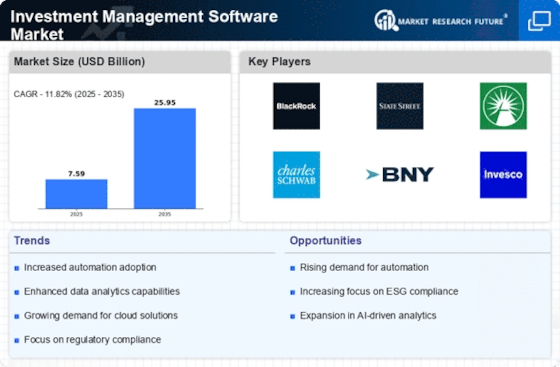

Rising Demand for Automation

The Investment Management Software Market is experiencing a notable surge in demand for automation solutions. As firms strive to enhance operational efficiency, automation tools are becoming essential. According to recent data, the market for automation in investment management is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is driven by the need to reduce manual errors, streamline processes, and improve decision-making speed. Automation not only minimizes operational costs but also allows firms to allocate resources more effectively. Consequently, investment management software that incorporates advanced automation features is likely to gain traction, as firms seek to remain competitive in a rapidly evolving landscape.

Increased Focus on Data Analytics

The Investment Management Software Market is witnessing an increased emphasis on data analytics capabilities. As investment firms accumulate vast amounts of data, the ability to analyze and derive actionable insights becomes paramount. Recent studies indicate that firms utilizing advanced analytics tools can enhance their investment performance by up to 15%. This trend is prompting software providers to integrate sophisticated analytics features into their offerings. By leveraging data analytics, firms can identify market trends, assess risks, and optimize portfolio management strategies. The growing recognition of data as a critical asset is likely to drive the demand for investment management software that prioritizes robust analytics functionalities.

Shift Towards Cloud-Based Solutions

The Investment Management Software Market is undergoing a significant shift towards cloud-based solutions. This transition is largely fueled by the need for flexibility, scalability, and cost-effectiveness. Recent market analysis suggests that the adoption of cloud-based investment management software is expected to increase by over 20% in the coming years. Cloud solutions enable firms to access their software from anywhere, facilitating remote work and collaboration. Additionally, they often come with lower upfront costs and reduced IT maintenance burdens. As firms continue to embrace digital transformation, the demand for cloud-based investment management software is likely to rise, reshaping the competitive landscape.