Expanded Thermoplastic Polyurethane E Tpu Size

Expanded Thermoplastic Polyurethane (E-TPU) Market Growth Projections and Opportunities

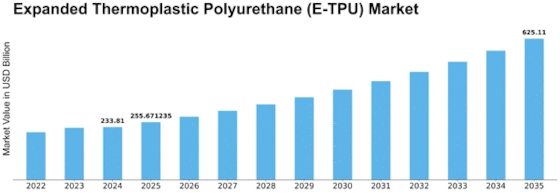

The global market for expanded thermoplastic polyurethane (E-TPU) witnessed significant growth, reaching a value of USD 239,728.9 million in 2017. Projections indicate a continued rise, with an expected Compound Annual Growth Rate (CAGR) of 10.76%, reaching USD 440,018.1 million by the end of 2023.

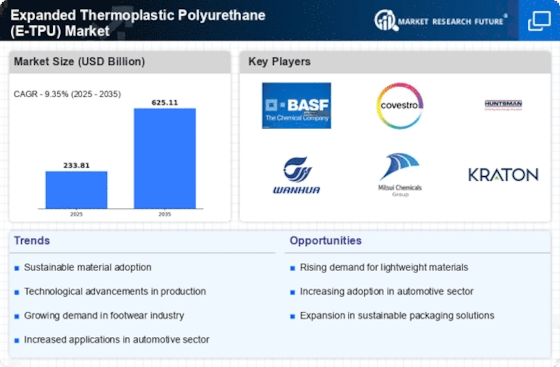

One major driver of the growing demand for E-TPU is its increasing use in sports shoe midsoles. This is due to its outstanding qualities such as high elasticity, softness, durability in extreme temperatures, excellent cushioning, and high impact resilience. The trend of higher spending on fitness accessories and sports equipment is contributing to the overall market growth. Additionally, the demand for casual and retro-style shoes, influenced by changing fashion trends, is further boosting the need for E-TPU.

E-TPU is finding adoption in various industries, including automotive, logistics, construction, and sports and leisure equipment, owing to its superior properties. This is expected to create substantial opportunities for market players in the upcoming years.

Despite the positive outlook, the global market faces challenges. The availability of close substitutes and fluctuations in raw material prices pose potential hindrances to market growth during the review period.

The market segmentation is based on application and region. In terms of application, the footwear segment dominates, accounting for the largest market share. In 2017, it was valued at USD 186,291.2 million, and projections indicate it will reach USD 350,307.5 million by 2023. This growth is primarily attributed to the rising demand for sports shoe midsoles with specific qualities like high elasticity and excellent cushioning.

Geographically, Asia-Pacific leads the market with a 59% share, valued at USD 141,993 million in 2017. The region is anticipated to reach USD 278,710.6 million by 2023, driven by an expanding industrial base and increasing per capita disposable income. Opportunities in the automotive industry, particularly in the production of hybrid and electric vehicles, further contribute to the growth in the Asia-Pacific market. North America and Europe are also significant markets for E-TPU, mainly due to the expanding footwear industry and increased spending on athletic footwear.

Leave a Comment