Top Industry Leaders in the Expanded Polystyrene Market

Expanded Polystyrene Market

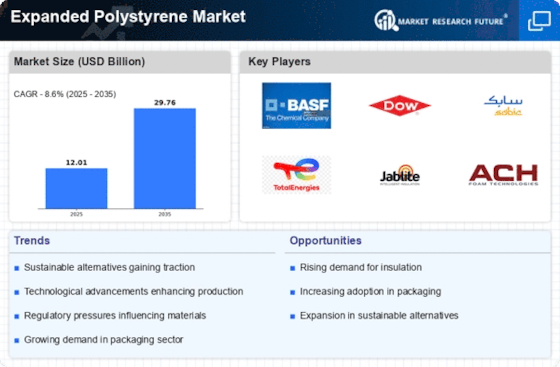

The expanded polystyrene (EPS) market, valued at over $10 billion globally, is a bustling arena where manufacturers vie for dominance. This lightweight, versatile material finds applications in construction, packaging, and various other industries, making it a lucrative market to tap into. However, competition is fierce, and understanding the landscape is crucial for success.

Market Share Strategies and Factors:

-

Product Differentiation: Major players like Knauf Insulation, BASF, and Saint-Gobain focus on developing innovative EPS grades with improved properties like fire retardancy, biodegradability, and energy efficiency. This caters to specific needs in different segments, securing market share. -

Regional Focus: Asia Pacific, with its booming construction and packaging industries, is a prime target. Companies like Asia Insulation Materials (AIM) and Sekisui Chemical are expanding their presence in this region, leveraging local knowledge and partnerships. -

Cost Optimization: EPS production is energy-intensive. Companies like Owens Corning implement efficient manufacturing processes and invest in renewable energy sources to lower costs and stay competitive. -

Sustainability Initiatives: Public pressure against traditional EPS due to its environmental impact is mounting. Companies are responding with initiatives like recycling programs, development of bio-based EPS alternatives, and collaborations with environmental organizations.

Some of the competitors operating in the expanded polystyrene market are

- BASF SE of Germany

- ACH Foam Technologies Inc of the United States

- Kaneka Corporation of Japan

-

SABIC of Saudi Arabia - Alpek S.A.B de C.v of Mexico

- Synbra Holding of the Netherlands

-

NOVA Chemicals Corporation of Cannada - StyroChem of Cannada

- Unipol Holand B.V of the Netherlands

- Versalis S.P of Italy

Recent Developments:

-

July 2023: A research team from MIT unveils a new method to convert EPS waste into valuable chemicals, potentially boosting its recycling potential and reducing environmental concerns. -

August 2023: The US Food and Drug Administration (FDA) approves the use of a bio-based EPS material for food packaging applications, opening doors for sustainable alternatives in the sector. -

September 2023: The Chinese government announces plans to invest in green building technologies, including the use of EPS for energy-efficient insulation in buildings, boosting demand in the Chinese construction market. -

October 2023: A group of European environmental NGOs launches a campaign against the use of EPS in packaging, calling for stricter regulations and promoting alternative materials. -

November 2023: BASF and Saint-Gobain collaborate on a joint research project to develop new fire-retardant EPS formulations, aiming to address safety concerns and expand application possibilities. -

December 2023: The International Council of Chemical Engineering (ICCE) releases a report highlighting the potential of EPS in lightweight automotive applications, suggesting a new avenue for market growth.