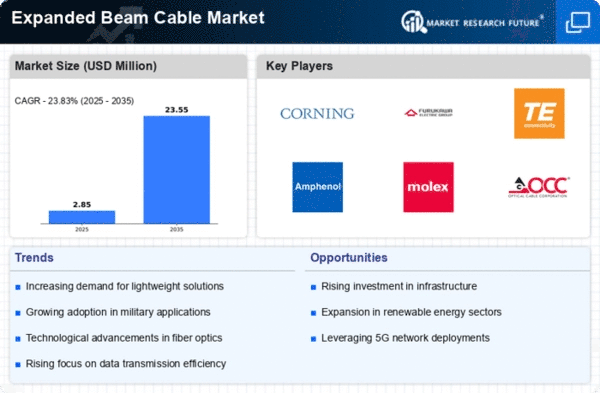

Market Growth Projections

The Global Expanded Beam Cable Market Industry is poised for substantial growth, with projections indicating a market value of 2.27 USD Billion in 2024 and an anticipated increase to 18.4 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 20.95% from 2025 to 2035. Such figures underscore the increasing reliance on advanced connectivity solutions across various sectors, including telecommunications, military, and data centers. The market's expansion is likely driven by technological advancements, rising demand for high-speed data transmission, and the growing adoption of expanded beam cables in emerging markets.

Growing Adoption in Military Applications

The Global Expanded Beam Cable Market Industry sees a notable increase in the adoption of expanded beam cables within military applications. These cables offer superior performance in challenging environments, making them ideal for defense communication systems. The military's need for reliable and secure data transmission drives the demand for advanced connectivity solutions. As defense budgets expand globally, investments in modern communication infrastructure are likely to rise, further propelling the market. The unique properties of expanded beam cables, such as resistance to dust and moisture, position them as a preferred choice for military applications, indicating a promising growth trajectory.

Technological Advancements in Fiber Optics

Technological advancements in fiber optics significantly influence the Global Expanded Beam Cable Market Industry. Innovations such as improved manufacturing techniques and enhanced materials contribute to the performance and durability of expanded beam cables. These advancements enable the production of cables that can withstand harsh environmental conditions, making them suitable for various applications, including military and aerospace. As technology evolves, the demand for high-performance cables is likely to increase, further driving market growth. The industry's trajectory suggests a strong alignment with future technological developments, potentially leading to increased adoption rates across multiple sectors.

Expansion of Data Centers and Cloud Services

The expansion of data centers and cloud services plays a crucial role in shaping the Global Expanded Beam Cable Market Industry. As organizations increasingly migrate to cloud-based solutions, the demand for high-capacity and efficient data transmission systems rises. Expanded beam cables, with their ability to support high data rates and long-distance transmission, are well-suited for data center applications. The global trend towards digital transformation and the growing reliance on cloud services suggest a sustained demand for these cables. This sector's growth is likely to contribute significantly to the overall market expansion, aligning with the projected increase in market value.

Rising Demand for High-Speed Data Transmission

The Global Expanded Beam Cable Market Industry experiences a surge in demand for high-speed data transmission solutions. As industries increasingly rely on data-intensive applications, the need for efficient and reliable connectivity becomes paramount. Expanded beam cables, known for their ability to minimize signal loss and enhance bandwidth, are becoming essential in sectors such as telecommunications and data centers. This trend is reflected in the projected market growth, with the industry expected to reach 2.27 USD Billion in 2024 and potentially expand to 18.4 USD Billion by 2035, indicating a robust CAGR of 20.95% from 2025 to 2035.

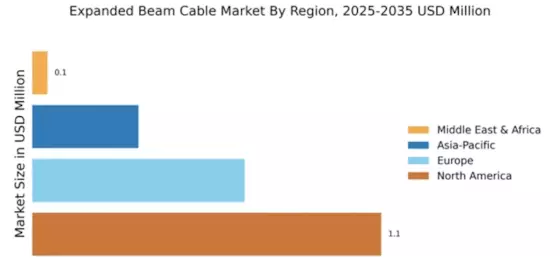

Emerging Markets and Infrastructure Development

Emerging markets and ongoing infrastructure development significantly impact the Global Expanded Beam Cable Market Industry. Countries investing in telecommunications and broadband infrastructure are likely to drive demand for advanced connectivity solutions. As urbanization accelerates and internet penetration increases, the need for reliable and high-speed data transmission becomes critical. Expanded beam cables, known for their efficiency and performance, are expected to play a vital role in these developments. The potential for growth in emerging markets presents opportunities for manufacturers and suppliers, suggesting a favorable environment for the expansion of the industry.