Growing Adoption in Industrial Automation

The US Expanded Beam Cable Market is experiencing growing adoption in the field of industrial automation. As industries increasingly embrace automation technologies, the need for reliable and efficient communication systems becomes essential. Expanded beam cables offer advantages such as reduced maintenance requirements and enhanced durability, making them ideal for harsh industrial environments. The manufacturing sector, in particular, is projected to invest heavily in automation solutions, with estimates suggesting a growth rate of around 7% annually. This trend is likely to drive the demand for expanded beam cables, as companies seek to optimize their operations and improve productivity. Consequently, the US Expanded Beam Cable Market stands to benefit from this shift towards automation, positioning itself as a key player in the evolving industrial landscape.

Technological Advancements in Fiber Optics

Technological advancements in fiber optics are playing a crucial role in shaping the US Expanded Beam Cable Market. Innovations in manufacturing processes and materials have led to the development of more efficient and durable expanded beam cables. These advancements not only improve performance but also reduce costs, making them more accessible to a wider range of applications. For instance, the introduction of new polymer materials has enhanced the flexibility and resilience of these cables, allowing for easier installation in various environments. As the demand for high-performance connectivity solutions continues to rise, the US Expanded Beam Cable Market is likely to benefit from these technological improvements, fostering greater adoption across sectors such as telecommunications, military, and industrial automation.

Rising Demand for High-Speed Data Transmission

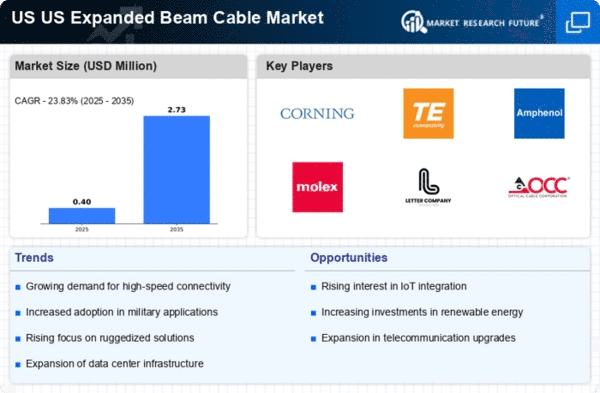

The US Expanded Beam Cable Market is experiencing a notable surge in demand for high-speed data transmission solutions. As businesses and consumers increasingly rely on high-bandwidth applications, the need for efficient and reliable connectivity has become paramount. Expanded beam cables, known for their ability to minimize signal loss and maintain high data integrity, are well-positioned to meet this demand. According to recent data, the telecommunications sector in the US is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This growth is likely to drive the adoption of expanded beam cables, as they offer superior performance compared to traditional fiber optic solutions. Consequently, the US Expanded Beam Cable Market is poised for significant expansion as organizations seek to enhance their network capabilities.

Increased Focus on Military and Defense Applications

The US Expanded Beam Cable Market is witnessing an increased focus on military and defense applications. The unique properties of expanded beam cables, such as their resistance to environmental factors and ability to maintain signal integrity over long distances, make them particularly suitable for military use. The US Department of Defense has been investing in advanced communication technologies, which includes the integration of expanded beam cables into their systems. This trend is expected to drive growth in the market, as military contracts often lead to substantial demand for high-performance connectivity solutions. Furthermore, the US Expanded Beam Cable Market may see increased collaboration between defense contractors and cable manufacturers, further solidifying its position in this critical sector.

Regulatory Support for Advanced Communication Technologies

Regulatory support for advanced communication technologies is emerging as a significant driver for the US Expanded Beam Cable Market. Government initiatives aimed at enhancing telecommunications infrastructure and promoting high-speed internet access are likely to create a favorable environment for expanded beam cable adoption. Policies that encourage investment in next-generation communication technologies can lead to increased funding for projects that utilize these advanced cables. For instance, the Federal Communications Commission has been actively working to expand broadband access across the country, which may indirectly boost the demand for high-performance connectivity solutions like expanded beam cables. As regulatory frameworks evolve to support technological advancements, the US Expanded Beam Cable Market is expected to experience growth driven by these supportive policies.