Rising Healthcare Expenditure

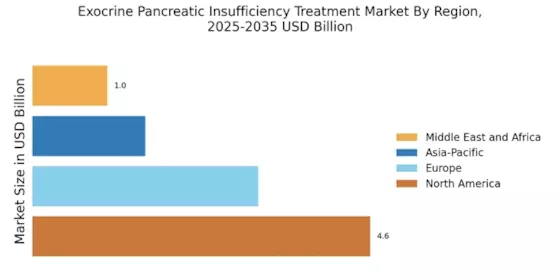

Rising healthcare expenditure across various regions is a crucial driver for the Exocrine Pancreatic Insufficiency Treatment Market. Increased investment in healthcare infrastructure and services facilitates better access to diagnostic tools and treatment options for EPI. Countries are allocating more resources to address chronic diseases, including EPI, which is reflected in the growing budgets for healthcare. This trend is likely to enhance the availability of pancreatic enzyme replacement therapies and other treatment modalities. As healthcare spending continues to rise, the Exocrine Pancreatic Insufficiency Treatment Market is poised for growth, with more patients receiving timely and effective care.

Growing Focus on Personalized Medicine

The growing focus on personalized medicine is reshaping the landscape of the Exocrine Pancreatic Insufficiency Treatment Market. Tailoring treatment plans to individual patient needs enhances therapeutic outcomes and minimizes adverse effects. This trend is particularly relevant in the management of EPI, where patient responses to enzyme replacement therapies can vary significantly. The integration of genetic testing and biomarker identification into treatment protocols may lead to more effective management strategies. As healthcare systems increasingly adopt personalized approaches, the demand for customized treatment options in the Exocrine Pancreatic Insufficiency Treatment Market is expected to rise, potentially improving patient quality of life.

Innovations in Enzyme Replacement Therapy

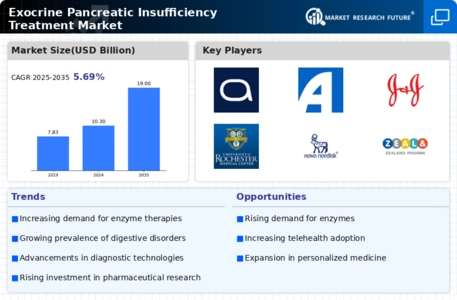

Innovations in enzyme replacement therapy (ERT) are significantly influencing the Exocrine Pancreatic Insufficiency Treatment Market. The introduction of new formulations and delivery methods for pancreatic enzyme supplements has enhanced patient compliance and treatment efficacy. For instance, enteric-coated formulations allow for better absorption in the intestine, which is crucial for patients with EPI. Market data indicates that the ERT segment is expected to witness a compound annual growth rate (CAGR) of over 6% in the coming years, driven by these advancements. As pharmaceutical companies continue to invest in research and development, the availability of more effective ERT options is likely to expand, thereby fostering growth in the Exocrine Pancreatic Insufficiency Treatment Market.

Enhanced Awareness and Education Initiatives

Enhanced awareness and education initiatives regarding exocrine pancreatic insufficiency are driving growth in the Exocrine Pancreatic Insufficiency Treatment Market. Healthcare organizations and patient advocacy groups are increasingly focusing on educating both healthcare professionals and patients about EPI. These initiatives aim to improve early diagnosis and treatment adherence, which are critical for managing the condition effectively. As awareness increases, more patients are likely to seek medical advice and treatment, thereby expanding the market. Furthermore, educational campaigns can lead to better understanding of the disease, ultimately contributing to improved patient outcomes in the Exocrine Pancreatic Insufficiency Treatment Market.

Increasing Prevalence of Exocrine Pancreatic Insufficiency

The rising incidence of exocrine pancreatic insufficiency (EPI) is a primary driver for the Exocrine Pancreatic Insufficiency Treatment Market. Conditions such as cystic fibrosis, chronic pancreatitis, and pancreatic cancer contribute to the growing number of patients diagnosed with EPI. Recent estimates suggest that approximately 1 in 10 individuals with chronic pancreatitis may develop EPI, indicating a substantial patient population requiring treatment. This increasing prevalence necessitates the development and availability of effective therapeutic options, thereby propelling market growth. As healthcare providers become more adept at diagnosing EPI, the demand for treatments is likely to escalate, further stimulating the Exocrine Pancreatic Insufficiency Treatment Market.