Technological Innovations in Stent Design

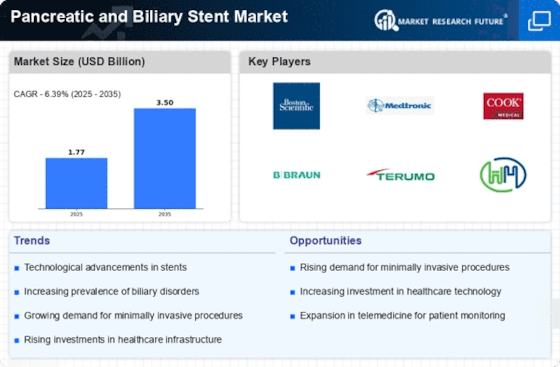

The Pancreatic and Biliary Stent Market is experiencing a surge in technological innovations that enhance the efficacy and safety of stents. Recent advancements include the development of biodegradable stents, which are designed to dissolve after fulfilling their purpose, thereby reducing the risk of long-term complications. Additionally, the integration of drug-eluting technologies is gaining traction, as these stents release medication to prevent restenosis. According to industry reports, the market for advanced stent technologies is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is driven by the increasing demand for effective treatment options for pancreatic and biliary disorders, which are often challenging to manage. As a result, the Pancreatic and Biliary Stent Market is likely to witness a shift towards more sophisticated and patient-friendly stent solutions.

Increased Investment in Healthcare Infrastructure

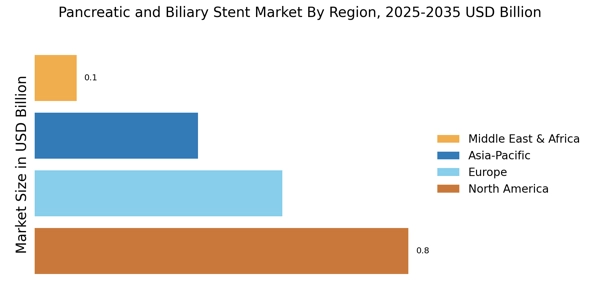

Investment in healthcare infrastructure is a critical driver for the Pancreatic and Biliary Stent Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in developing regions. This investment is aimed at improving access to advanced medical technologies, including stenting procedures for pancreatic and biliary disorders. Enhanced healthcare infrastructure not only facilitates the availability of stents but also promotes training for healthcare professionals in the latest techniques. As a result, the market is expected to experience growth, with projections indicating a potential increase in stent usage as facilities become better equipped. The Pancreatic and Biliary Stent Market stands to gain from these developments, as improved infrastructure correlates with higher patient volumes and better treatment outcomes.

Rising Incidence of Pancreatic and Biliary Disorders

The prevalence of pancreatic and biliary disorders is on the rise, significantly impacting the Pancreatic and Biliary Stent Market. Conditions such as pancreatitis, pancreatic cancer, and biliary obstruction are becoming increasingly common, particularly among older adults. Data indicates that pancreatic cancer is one of the fastest-growing cancer types, with an estimated increase in incidence rates. This trend is likely to drive demand for stenting procedures, as they are often necessary to alleviate symptoms and improve patient outcomes. Furthermore, the growing awareness of these disorders and the importance of early diagnosis are contributing to an uptick in procedures requiring stenting. Consequently, the Pancreatic and Biliary Stent Market is poised for growth as healthcare providers seek effective solutions to manage these complex conditions.

Shift Towards Minimally Invasive Surgical Techniques

The Pancreatic and Biliary Stent Market is witnessing a notable shift towards minimally invasive surgical techniques, which are preferred for their reduced recovery times and lower complication rates. As healthcare systems increasingly adopt these techniques, the demand for stents that facilitate such procedures is expected to rise. Endoscopic retrograde cholangiopancreatography (ERCP) is a prime example, where stents play a crucial role in managing biliary obstructions. The market for minimally invasive devices is projected to expand significantly, with estimates suggesting a growth rate of around 7% annually. This trend reflects a broader movement within the medical community to enhance patient care through less invasive options. As a result, the Pancreatic and Biliary Stent Market is likely to benefit from this paradigm shift, leading to increased adoption of innovative stenting solutions.

Growing Awareness and Education on Gastrointestinal Health

The Pancreatic and Biliary Stent Market is benefiting from a growing awareness and education regarding gastrointestinal health. Public health campaigns and educational initiatives are increasingly focusing on the importance of recognizing symptoms associated with pancreatic and biliary disorders. This heightened awareness is likely to lead to earlier diagnosis and treatment, thereby increasing the demand for stenting procedures. Furthermore, healthcare providers are emphasizing the significance of preventive care, which may contribute to a rise in the number of patients seeking treatment for these conditions. As awareness continues to grow, the Pancreatic and Biliary Stent Market is expected to expand, driven by an increase in patient engagement and proactive healthcare measures.