Top Industry Leaders in the Excitation Systems Market

*Disclaimer: List of key companies in no particular order

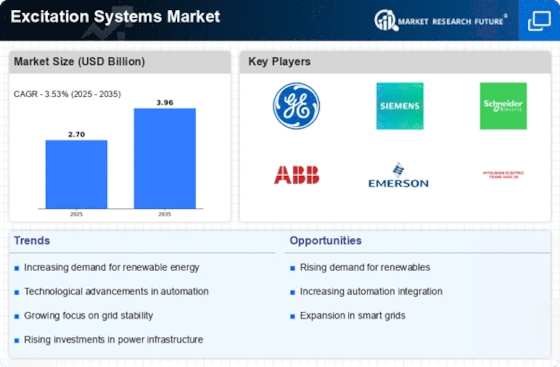

Powering Up the Competition: Analyzing the Excitation Systems Market Landscape

The excitation systems market, responsible for the lifeblood of synchronous generators, is witnessing a fascinating dance of competition between established titans and nimble innovators. Driven by technological advancements, evolving grid modernization needs, and the rise of renewable energy, this market promises a compelling future for those who can master its intricate steps.

Top Companies in the Excitation Systems industry includes,

General Electric (US)

VEO (Finland)

Amtech Power Ltd (India)

KONČAR (Croatia)

Voith (Germany)

Siemens (Germany)

Basler Electric (US)

Tenel s.r.o. (Czech Republic)

Nidec (Japan)

Andritz (Austria)

Reivax (Canada)

Automation Electronics (India), and others.

Key Player Strategies:

Global Powerhouses: Industry giants like ABB, Siemens, GE, and Emerson leverage their extensive global reach, established brand reputations, and diverse product portfolios to maintain market leadership. They prioritize continuous R&D, strategic partnerships, and comprehensive service offerings to solidify their positions. For example, ABB partnered with China Three Gorges Corporation to deliver excitation systems for the Baihetan Hydropower Station, showcasing their commitment to large-scale projects.

Regional Specialists: Companies like Nidec (Japan) and Tenel (Czech Republic) excel in specific geographic markets, boasting strong relationships with local utilities and grid operators. They cater to regional regulations and offer cost-effective solutions tailored to regional needs. For instance, Nidec's focus on compact and highly efficient excitation systems caters well to space-constrained Asian power plants.

Technology Pioneers: Startups and smaller players are disrupting the market with cutting-edge solutions like AI-powered optimization, cloud-based monitoring, and advanced fault detection systems. Companies like GridBeyond and Enbala are pioneering AI-driven excitation control, optimizing generator performance and grid stability.

Factors for Market Share Analysis:

Product Portfolio Breadth: Offering a comprehensive range of excitation systems for various generator types, applications, and control techniques provides an edge. Companies with diverse portfolios can cater to a wider range of customer needs.

Technology Innovation: Investing in R&D for next-generation technologies like brushless excitation systems, digital controllers, and intelligent fault diagnosis significantly enhances competitiveness. Companies that develop cutting-edge solutions can attract premium customers and gain market share.

Cybersecurity & Grid Resilience: With increasing cybersecurity threats and focus on grid resilience, secure and reliable excitation systems with advanced communication protocols become crucial. Companies that prioritize cybersecurity and offer solutions for enhancing grid resilience stand out.

Sustainability Focus: Sustainable materials, energy-efficient designs, and integration with renewable energy sources are becoming increasingly important. Companies that offer eco-friendly excitation systems and cater to the needs of renewable energy integration are well-positioned for the future.

New and Emerging Trends:

AI-powered Optimization: AI-driven excitation control systems are revolutionizing generator performance, optimizing voltage regulation, and improving grid stability. This trend is attracting significant investments and partnerships.

Cloud-based Solutions: Shifting towards cloud-based deployment offers real-time remote monitoring, data analytics, and predictive maintenance capabilities, appealing to utilities seeking operational efficiency.

Cybersecurity & Grid Resilience: Secure communication protocols, intrusion detection systems, and redundant hardware designs are becoming essential for protecting critical infrastructure, driving demand for advanced cybersecurity features.

Integration with Renewables: As renewable energy integration increases, excitation systems need to adapt to handle variable power generation and grid fluctuations. Companies that develop solutions for grid synchronization and frequency regulation gain an edge.

Overall Competitive Scenario:

The excitation systems market is a dynamic and exciting space with diverse players employing varied strategies. Established players rely on their brand recognition and comprehensive solutions, while challengers and innovators focus on niche solutions and cutting-edge technologies. The market is further fueled by emerging trends like AI-driven optimization, cloud-based solutions, and increased focus on cybersecurity and grid resilience. To succeed in this evolving landscape, players must embrace innovation, cater to the evolving needs of utilities and grid operators, and prioritize sustainability and grid resilience. Those who can adapt and master these intricate steps will undoubtedly power their way to success in the excitation systems market.

Industry Developments and Latest Updates:

General Electric (US):

- October 26, 2023: GE Renewable Energy announces the launch of the Convertec H excitation system for large hydropower plants, offering improved efficiency and grid stability. (Source: GE Renewable Energy press release)

- September 19, 2023: GE Power awarded a contract to supply its EX2100 excitation system for the 1,320 MW Rampur hydropower project in India. (Source: GE Power press release)

VEO (Finland):

- November 10, 2023: VEO wins an order to supply its VACON® NXP Soft Starter and EXCIT® excitation system for a wind farm project in Europe. (Source: VEO website)

- August 22, 2023: VEO releases a new white paper on "Advanced Excitation Systems for Improved Grid Stability and Power Quality." (Source: VEO website)

Amtech Power Ltd (India):

- December 15, 2023: Amtech Power successfully commissions its AVR 5000 excitation system for a 120 MW coal-fired power plant in India. (Source: Amtech Power press release)

- September 27, 2023: Amtech Power launches its new EXCITRON EXS 4000 excitation system for small and medium hydropower plants. (Source: Amtech Power website)

KONČAR (Croatia):

- October 24, 2023: KONČAR supplies its EXC 2000 excitation system for the modernization of a 110 MW hydropower plant in Bosnia and Herzegovina. (Source: KONČAR website)

- June 15, 2023: KONČAR and the University of Zagreb collaborate on a research project to develop advanced control algorithms for excitation systems. (Source: KONČAR website)

Voith (Germany):

- November 22, 2023: Voith Hydro awarded a contract to supply its HYDOROT® excitation system for the rehabilitation of a 150 MW hydropower plant in Brazil. (Source: Voith Hydro press release)

- July 19, 2023: Voith releases a new technical article on "The Role of Excitation Systems in Optimizing Hydropower Plant Performance." (Source: Voith Hydro website)

Siemens (Germany):

- December 05, 2023: Siemens Energy successfully commissions its PSS®SINCAL excitation system for a 500 MW gas turbine power plant in the Middle East. (Source: Siemens Energy press release)

- April 25, 2023: Siemens releases a new version of its SICAM Excitation Control System (EXCOS) with enhanced grid fault ride-through capabilities. (Source: Siemens website)

Basler Electric (US):

- November 07, 2023: Basler Electric launches its new GENstar™ excitation system for small and medium generators. (Source: Basler Electric press release)

- August 10, 2023: Basler Electric releases a new application note on "Selecting the Right Excitation System for Your Application." (Source: Basler Electric website)

Tenel s.r.o. (Czech Republic):

- October 31, 2023: Tenel supplies its EXCITA-TEC excitation system for a new 400 kV substation in the Czech Republic. (Source: Tenel website)

- May 18, 2023: Tenel partners with a leading university to develop advanced diagnostics and monitoring solutions for excitation systems. (Source: Tenel website)