Focus on Energy Efficiency

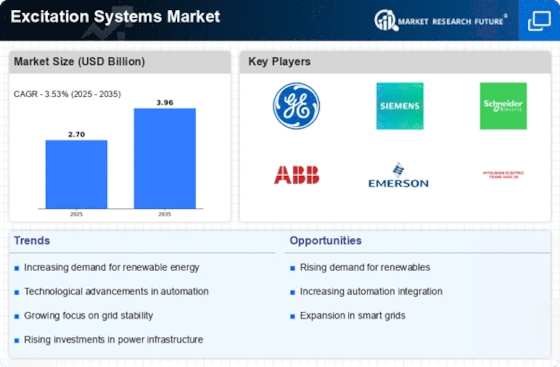

The Excitation Systems Industry. As energy costs continue to rise, power generation facilities are increasingly seeking solutions that enhance operational efficiency. Excitation systems play a crucial role in optimizing the performance of generators, thereby reducing fuel consumption and operational costs. Recent studies indicate that implementing advanced excitation systems can lead to efficiency improvements of up to 10% in power generation. This focus on energy efficiency aligns with broader sustainability goals, prompting utilities to invest in modern excitation technologies. As a result, the Excitation Systems Market is poised for growth as stakeholders prioritize solutions that contribute to both economic and environmental sustainability.

Regulatory Support for Modernization

Regulatory frameworks supporting the modernization of power generation infrastructure are influencing the Excitation Systems Market. Many countries are implementing policies that encourage the adoption of advanced technologies to enhance grid reliability and reduce emissions. These regulations often mandate the use of modern excitation systems in new power plants and retrofitting existing facilities. Data indicates that compliance with these regulations can lead to improved operational performance and reduced environmental impact. As utilities strive to meet regulatory requirements, the demand for advanced excitation systems is expected to rise. This regulatory support not only drives innovation within the Excitation Systems Market but also fosters a competitive landscape for technology providers.

Increasing Demand for Power Generation

The rising demand for electricity across various sectors is a primary driver for the Excitation Systems Market. As urbanization and industrialization continue to expand, the need for reliable power generation becomes critical. According to recent data, the global electricity consumption is projected to increase by approximately 2.5% annually. This surge necessitates the deployment of advanced excitation systems to enhance the efficiency and stability of power plants. Furthermore, the integration of renewable energy sources into the grid requires sophisticated excitation systems to manage fluctuations in power supply. Consequently, the Excitation Systems Market is likely to experience substantial growth as power generation facilities invest in modern technologies to meet this escalating demand.

Rising Investments in Renewable Energy

The increasing investments in renewable energy projects are driving the Excitation Systems Market. Governments and private entities are allocating substantial resources to develop wind, solar, and hydroelectric power generation facilities. These renewable sources require specialized excitation systems to ensure optimal performance and grid integration. Market analysis suggests that the renewable energy sector is expected to attract investments exceeding 1 trillion dollars over the next decade. This influx of capital is likely to stimulate demand for advanced excitation systems that can effectively manage the unique challenges posed by renewable energy generation. Consequently, the Excitation Systems Market stands to benefit significantly from this trend as new projects emerge globally.

Integration of Advanced Control Systems

The integration of advanced control systems into power generation facilities is significantly influencing the Excitation Systems Market. Modern excitation systems are increasingly being equipped with digital control technologies that enhance their performance and reliability. These systems allow for real-time monitoring and adjustments, which are essential for maintaining grid stability, especially with the growing penetration of intermittent renewable energy sources. Market data indicates that the adoption of digital excitation systems is expected to grow at a compound annual growth rate of over 6% in the coming years. This trend suggests that power plants are prioritizing the implementation of advanced control mechanisms to optimize their operations, thereby driving the demand within the Excitation Systems Market.