Increased Cybersecurity Threats

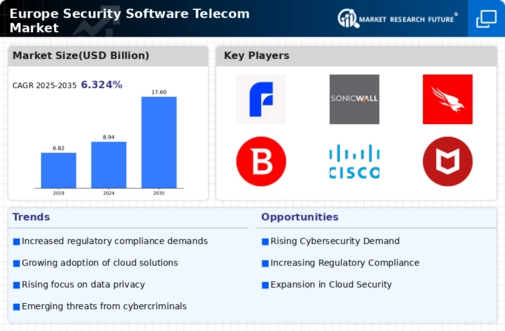

The Europe Security Software Telecom Market is currently experiencing a surge in cybersecurity threats, which appears to be driving demand for robust security solutions. With the rise of sophisticated cyberattacks, including ransomware and phishing schemes, telecom companies are compelled to enhance their security measures. According to recent data, the European cybersecurity market is projected to grow at a compound annual growth rate of 10.5% from 2023 to 2028. This growth is indicative of the increasing investments in security software by telecom operators, who are prioritizing the protection of sensitive customer data and network integrity. As a result, the industry is witnessing a shift towards comprehensive security solutions that can address these evolving threats.

Growing Adoption of Cloud Services

The Europe Security Software Telecom Market is witnessing a notable shift towards the adoption of cloud services, which is driving the demand for security software solutions. As telecom companies increasingly migrate their operations to the cloud, the need for robust security measures to protect sensitive data becomes paramount. Recent statistics indicate that the cloud security market in Europe is expected to reach USD 20 billion by 2026, reflecting a growing recognition of the importance of securing cloud environments. This trend is prompting telecom operators to invest in advanced security software that can safeguard their cloud infrastructures, thereby enhancing their overall security posture in an increasingly digital landscape.

Regulatory Compliance Requirements

The Europe Security Software Telecom Market is significantly influenced by stringent regulatory compliance requirements. The General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive impose strict guidelines on data protection and cybersecurity practices. Telecom operators are required to implement advanced security measures to comply with these regulations, which has led to an increased demand for security software solutions. The market is expected to see a rise in investments as companies strive to avoid hefty fines and reputational damage associated with non-compliance. This regulatory landscape is likely to propel the growth of the security software sector within the telecom industry, as organizations seek to align their operations with legal requirements.

Increased Focus on Customer Privacy

The Europe Security Software Telecom Market is increasingly prioritizing customer privacy, which is becoming a critical driver for security software adoption. With growing consumer awareness regarding data protection, telecom companies are under pressure to implement stringent security measures to safeguard personal information. This heightened focus on privacy is prompting investments in security software solutions that ensure compliance with data protection regulations and enhance customer trust. As a result, the market is likely to see a rise in demand for security solutions that offer transparency and robust privacy features. This trend reflects a broader societal shift towards valuing data privacy, which is expected to shape the future of the telecom industry.

Integration of Advanced Technologies

The Europe Security Software Telecom Market is experiencing a transformation through the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies are being utilized to enhance threat detection and response capabilities, allowing telecom operators to proactively address security challenges. The implementation of AI-driven security solutions is expected to improve the efficiency of security operations, reducing response times to incidents. As the market evolves, telecom companies are likely to invest in innovative security software that leverages these technologies to stay ahead of emerging threats. This integration not only strengthens security measures but also positions telecom operators as leaders in the competitive landscape.