Emergence of 5G Technology

The US Security Software Telecom Market is poised for growth with the emergence of 5G technology. The rollout of 5G networks is expected to revolutionize telecommunications, offering faster speeds and enhanced connectivity. However, this advancement also introduces new security challenges that must be addressed. As 5G networks become more prevalent, telecom companies are compelled to invest in security software that can protect against potential vulnerabilities associated with this technology. Analysts predict that the 5G security market will reach USD 10 billion by 2026, highlighting the urgency for telecom providers to implement effective security measures to safeguard their networks and customer data.

Growing Cybersecurity Threats

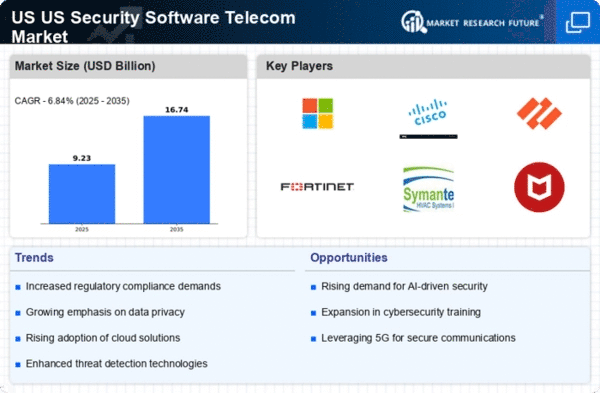

The US Security Software Telecom Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. In 2025, the FBI reported a 30 percent rise in cybercrime incidents compared to previous years, prompting telecom companies to invest heavily in security software solutions. This trend indicates that organizations are prioritizing cybersecurity to protect sensitive data and maintain customer trust. As a result, the market for security software is projected to grow at a compound annual growth rate (CAGR) of 12 percent through 2026. The urgency to combat these threats is driving innovation and the development of advanced security solutions tailored for the telecom sector.

Regulatory Compliance Requirements

The US Security Software Telecom Market is significantly influenced by stringent regulatory compliance requirements. The Federal Communications Commission (FCC) and other regulatory bodies have established guidelines that mandate telecom companies to implement robust security measures. Non-compliance can lead to hefty fines and reputational damage, which has compelled organizations to adopt comprehensive security software solutions. In 2025, it was estimated that compliance-related investments accounted for approximately 25 percent of total IT security budgets in the telecom sector. This trend underscores the necessity for security software that not only meets regulatory standards but also enhances overall security posture.

Shift Towards Cloud-Based Solutions

The US Security Software Telecom Market is witnessing a notable shift towards cloud-based security solutions. As telecom companies increasingly migrate their operations to the cloud, the demand for security software that can effectively protect cloud environments is rising. According to industry reports, the cloud security market is expected to reach USD 20 billion by 2026, driven by the need for scalable and flexible security solutions. This transition is prompting telecom providers to invest in advanced security software that can seamlessly integrate with cloud infrastructure, ensuring data protection and compliance. The growing reliance on cloud services is reshaping the security landscape within the telecom sector.

Increased Investment in Digital Transformation

The US Security Software Telecom Market is benefiting from the heightened investment in digital transformation initiatives. Telecom companies are increasingly adopting digital technologies to enhance operational efficiency and customer experience. This transformation necessitates robust security measures to safeguard digital assets. In 2025, it was reported that telecom firms allocated over USD 15 billion towards digital transformation projects, with a significant portion directed towards security software solutions. This trend suggests that as telecom companies embrace digitalization, the demand for advanced security software will continue to grow, ensuring that they can mitigate risks associated with new technologies.