Growing consumer interest in robotic taxis is driving market growth

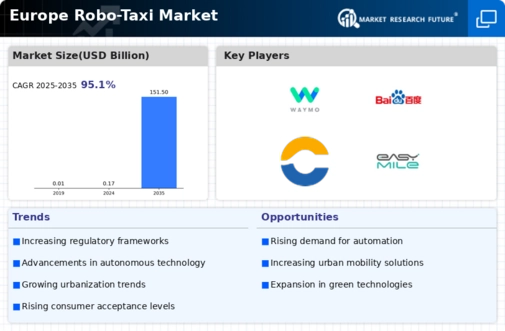

The European Robo-Taxi market CAGR is expanding because almost all manufacturers are testing and introducing electrified and autonomous vehicles across Europe. Many are embracing the Robo-taxi notion, the basis for which technology and car manufacturing businesses have begun working on it. Most manufacturers are testing autonomous taxis to observe the outcomes and reactions of consumers. In Europe, several companies offering robot taxi services are starting up. The market is expected to have a favorable outlook due to the rise of autonomous vehicles and electric mobility. For instance, in 2021, over 70% of EV sales came from passenger automobiles.

Due to increased demand in Europe, the SUV segment of the passenger automobile market has been expanding during the last few years. Autonomous vehicle-based mobility services are anticipated to replace private and public transportation trips for consumers without cars. Robo-taxis is a viable alternative to traditional public transportation for about 45% of those without regular car access. A quarter of the population would rather take robo-cabs than traditional taxis.

However, car owners would have to be persuaded that Robo-taxis would provide an experience that was at least the same as theirs in terms of independence, comfort, and convenience for them to convert to the service. The demand for car-based mobility will rise as soon as robo-taxis are seen as more convenient than vehicles, which they most definitely have the potential to be.

Additionally, a key trend in the market is the increasing availability of emission-free and fuel-efficient automobiles. Manufacturers can now create electric and fuel-cell-powered automobiles because of the tightening emission regulations. Because Robotaxi is completely self-sufficient, it requires a sophisticated and effective fuel system to operate. It is anticipated that as these vehicles become more widely used, traffic congestion will decrease, improving air quality and lowering emissions. Vehicles with lower energy use also typically have lower operating expenses. For instance, electric vehicles' fuel and maintenance expenses are cheaper than those of conventional combustion engine vehicles.

This affordability may motivate companies to run fleets of robot taxis, resulting in a rise in market share and adoption. Thus, driving the Europe Robo-Taxi market revenue.

Leave a Comment