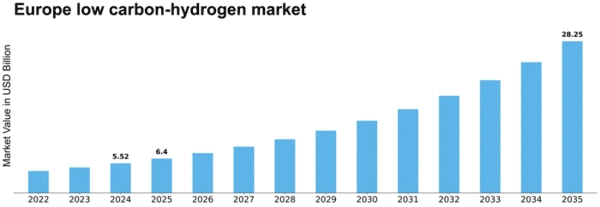

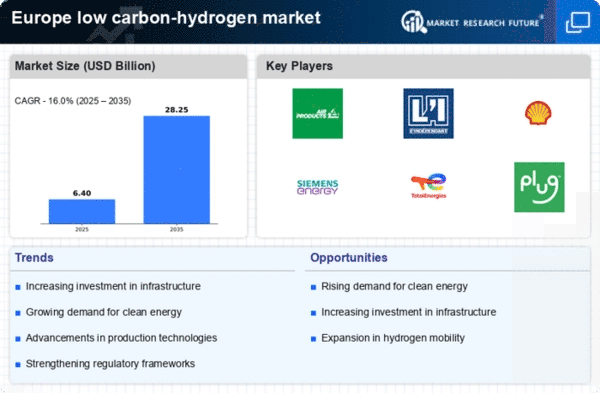

Europe Low Carbon Hydrogen Size

Europe low carbon hydrogen market Growth Projections and Opportunities

The market dynamics of the low-carbon hydrogen sector in Europe are undergoing a transformative shift, driven by a combination of environmental imperatives, technological advancements, and a commitment to decarbonize various industries. One of the central drivers shaping this market is the European Union's ambitious climate goals, aiming to achieve carbon neutrality by 2050. Low-carbon hydrogen, produced with minimal greenhouse gas emissions, is positioned as a key enabler in this transition, influencing the market dynamics by fostering innovation and investments in sustainable hydrogen production technologies.

Technological advancements in hydrogen production methods play a pivotal role in shaping the dynamics of the low-carbon hydrogen market in Europe. Electrolysis, particularly through the use of renewable energy sources, emerges as a critical technological driver. Green hydrogen production, where electrolysis utilizes renewable electricity to split water into hydrogen and oxygen, is gaining prominence. Additionally, advancements in other low-carbon hydrogen production pathways, such as blue hydrogen with carbon capture and storage (CCS), contribute to the evolving dynamics of the market.

Government policies and regulatory frameworks are fundamental drivers influencing the dynamics of the low-carbon hydrogen market in Europe. The European Commission's Hydrogen Strategy and the National Hydrogen Strategies adopted by various European countries set out clear objectives and financial incentives to support the development and deployment of low-carbon hydrogen. The dynamics are shaped by the creation of a supportive policy environment, including financial instruments, subsidies, and market mechanisms, to stimulate investment in low-carbon hydrogen projects.

Market dynamics are also influenced by economic considerations and the decreasing costs associated with low-carbon hydrogen production. As the costs of renewable energy and electrolyzer technologies continue to decline, the dynamics of the low-carbon hydrogen market become increasingly favorable. This cost competitiveness not only attracts investments but also positions low-carbon hydrogen as a viable and cost-effective solution for various industrial applications, mobility, and energy storage.

Consumer awareness and corporate sustainability goals contribute significantly to the market dynamics of low-carbon hydrogen in Europe. The increasing emphasis on corporate social responsibility and environmental sustainability drives demand for clean energy solutions, including low-carbon hydrogen. The dynamics are shaped by businesses and consumers seeking to reduce their carbon footprint by incorporating low-carbon hydrogen into their energy mix, further encouraging investments and advancements in the sector.

Infrastructure development is a critical factor influencing the dynamics of the low-carbon hydrogen market in Europe. The expansion of hydrogen infrastructure, including transportation, storage, and distribution networks, is essential for the widespread adoption of low-carbon hydrogen. The dynamics are shaped by investments in infrastructure projects, such as hydrogen refueling stations and pipelines, to create a robust and interconnected hydrogen ecosystem capable of supporting the growth of the low-carbon hydrogen market.

International collaborations and partnerships contribute to the dynamics of the low-carbon hydrogen market in Europe. Cross-border cooperation allows for the exchange of expertise, resources, and best practices in low-carbon hydrogen production and utilization. The dynamics are influenced by initiatives such as the European Clean Hydrogen Alliance, fostering collaboration between industry stakeholders, governments, and research institutions to accelerate the development and deployment of low-carbon hydrogen technologies.

The low-carbon hydrogen market dynamics in Europe are characterized by a multi-faceted approach, encompassing technological advancements, government policies, economic considerations, consumer preferences, infrastructure development, and international collaborations. As the region pursues its climate goals and strives for a sustainable energy future, the dynamics of the low-carbon hydrogen market are expected to continue evolving, fostering innovation and driving the widespread adoption of low-carbon hydrogen across various sectors in Europe.

Leave a Comment