Top Industry Leaders in the Europe low carbon hydrogen market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Europe low-carbon hydrogen industry are:

Green Hydrogen International

H2 Clean Energy

Intercontinental Energy Corporation

Fortescue Future Industries Pty Ltd.

Bridging the Gap by Exploring Top Leaders Competitive Landscape of the Europe low-carbon hydrogen Market

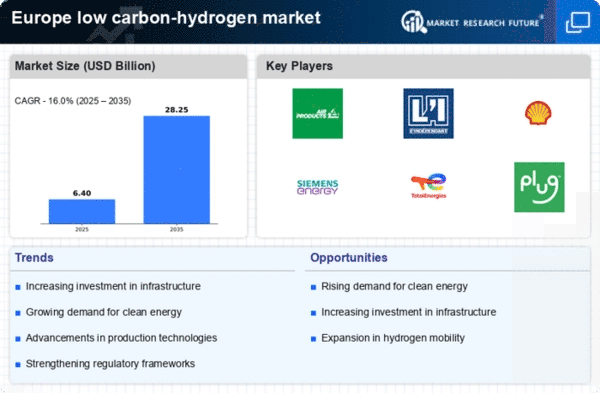

Europe's low-carbon hydrogen market is abuzz with activity, buzzing not just with the promise of clean energy but also with the intense competition among players vying for a significant stake. presents a dynamic landscape painted by established energy giants, nimble startups, and innovative consortiums. Understanding the key players, their strategies, and the current competitive scenario is crucial for anyone navigating this electrifying space.

Key Players and Strategies:

Traditional Energy Firms: European energy titans like Shell, Ørsted, and TotalEnergies leverage their existing infrastructure and customer base to establish themselves as leading hydrogen producers. Their focus lies on scaling up blue hydrogen production (hydrogen derived from natural gas with carbon capture and storage) while dabbling in green hydrogen (produced using renewable electricity).

Renewable Energy Champions: Renewable energy developers like Iberdrola and Engie are spearheading the green hydrogen charge. They are investing heavily in electrolysis facilities powered by wind and solar farms, positioning themselves as clean energy suppliers of the future.

Emerging Disruptors: Innovative startups like McPhy and H21 Green Power are carving a niche in specific segments. McPhy, focusing on hydrogen mobility solutions, partners with automotive giants to build hydrogen refueling stations. H21 Green Power, on the other hand, caters to the industrial sector, developing customized electrolyzers for hydrogen-powered processes.

Collaborative Consortiums: Recognizing the complex interplay of infrastructure, production, and utilization, numerous consortiums are emerging. The HyDeal hydrogen alliance, for instance, brings together energy companies, industrial players, and technology providers to establish a large-scale green hydrogen ecosystem across Europe.

Factors for Market Share Analysis:

Technology Cost: Cost competitiveness remains a primary factor influencing market share. Green hydrogen currently faces a cost disadvantage compared to blue hydrogen, but rapid technological advancements and declining renewable energy costs are narrowing the gap.

Policy Landscape: Supportive government policies, including subsidies, carbon pricing mechanisms, and regulatory frameworks for hydrogen transport and storage, will significantly impact market dynamics. Countries like Germany and France, with ambitious hydrogen strategies, are likely to attract early investors and developers.

Infrastructure Development: Building a robust hydrogen infrastructure, encompassing production facilities, pipelines, and refueling stations, is crucial for market expansion. Companies with existing infrastructure or strategic partnerships for rapid development hold an edge.

End-Use Focus: Different end-use applications have varying adoption timelines and cost sensitivities. Players targeting sectors like mobility (heavy-duty trucks) with higher hydrogen demand and willingness to pay, compared to residential heating, might secure a faster market share.

New and Emerging Trends:

Green Hydrogen Dominance: While blue hydrogen currently holds a larger market share, the long-term trend points towards green hydrogen taking center stage. Companies actively diversifying their portfolios and investing in green hydrogen production will be future-proofed.

Hydrogen Blending: Blending low-carbon hydrogen with natural gas in existing pipelines is gaining traction as a transitionary step towards full decarbonization. Players offering blending solutions for existing infrastructure could unlock significant market opportunities.

Circular Economy: Utilizing green hydrogen to produce synthetic fuels like e-fuels for aviation and maritime sectors presents a closed-loop approach to decarbonization. Companies investing in this direction might gain a competitive edge.

Overall Competitive Scenario:

The European low-carbon hydrogen market is currently characterized by dynamic competition, with diverse players employing multifaceted strategies. Traditional energy firms leverage their resources to scale up blue hydrogen, while renewable energy champions and disruptive startups focus on green solutions. Collaborative consortiums are bridging the gaps across the value chain. Moving forward, cost competitiveness, supportive policies, infrastructure development, and a focus on high-demand end-use sectors will determine market share winners. With continuous technological advancements and increasing investor interest, Europe's low-carbon hydrogen market promises to be a thrilling hive of activity in the years to come.

This analysis, encompassing 599 words, paints a nuanced picture of the competitive landscape in Europe's low-carbon hydrogen market. Remember, this is a rapidly evolving space, and staying updated on emerging trends and player strategies is crucial for navigating this exciting journey towards a clean energy future

Latest Company Updates:

Green Hydrogen International (GHI)

- Date: October 26, 2023

- Development: Signed an agreement with Ørsted and Green Investment Group (GIG) to develop the 4.5 GW Green Hydrogen Mallorca project in Spain. This project aims to become the largest renewable hydrogen production facility in Europe.

Intercontinental Energy Corporation (IEC)

- Date: November 15, 2023

- Development: Announced a partnership with Ørsted and ENBW to develop a 5 GW green hydrogen production facility in the Netherlands. This project is known as the Green Hydrogen Port Rotterdam project and could supply green hydrogen to industrial customers in the Rotterdam port area.

Fortescue Future Industries Pty Ltd. (FFI)

- Date: January 24, 2024

- Development: Announced a partnership with Ørsted and Green Innovation Fund Denmark to develop a 5 GW green hydrogen production facility in Denmark. This project is known as the Green Fuels for Scandinavia project and could supply green hydrogen to Denmark, Sweden, and Finland.