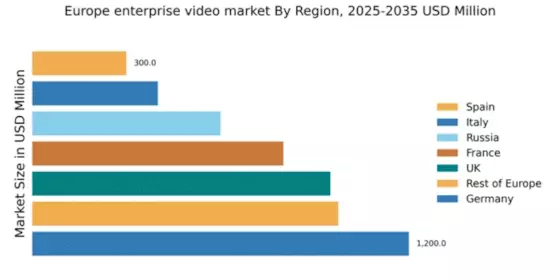

Germany : Strong Growth and Innovation Hub

Germany holds a commanding market share of 30% in the European enterprise video market, valued at $1,200.0 million. Key growth drivers include a robust digital infrastructure, increasing demand for remote collaboration tools, and government initiatives promoting digital transformation. The regulatory environment is supportive, with policies aimed at enhancing cybersecurity and data protection, which are crucial for enterprise video solutions. Industrial development in tech hubs like Berlin and Munich further fuels demand.

UK : Innovation and Adoption on the Rise

The UK enterprise video market is valued at $950.0 million, representing approximately 24% of the European market. Growth is driven by the increasing adoption of hybrid work models and the demand for seamless communication tools. Regulatory frameworks are evolving to support data privacy, enhancing user trust. The UK's strong tech ecosystem, particularly in London and Manchester, fosters innovation and attracts investment in video technologies.

France : Cultural Shift Towards Digital Engagement

France's enterprise video market is valued at $800.0 million, accounting for 20% of the European market. The growth is propelled by a cultural shift towards digital engagement and remote work solutions. Government initiatives, such as the Digital France 2020 plan, support the adoption of digital tools. Key cities like Paris and Lyon are central to this growth, with a competitive landscape featuring major players like Cisco and Zoom.

Russia : Growing Demand Amidst Challenges

Russia's enterprise video market is valued at $600.0 million, representing 15% of the European market. Key growth drivers include increasing internet penetration and a shift towards digital communication. However, regulatory challenges and geopolitical factors impact market dynamics. Major cities like Moscow and St. Petersburg are key markets, with local players competing alongside international giants like Microsoft and IBM.

Italy : Focus on Collaboration and Connectivity

Italy's enterprise video market is valued at $400.0 million, making up 10% of the European market. Growth is driven by a focus on collaboration tools and enhanced connectivity in businesses. Government initiatives aimed at digitalization support this trend. Key markets include Milan and Rome, where major players like Adobe and Kaltura are establishing a strong presence, catering to various sectors including education and corporate training.

Spain : Adapting to Digital Transformation

Spain's enterprise video market is valued at $300.0 million, representing 8% of the European market. The growth is fueled by the need for digital transformation in businesses and the rise of remote work. Regulatory support for digital initiatives enhances market potential. Key cities like Madrid and Barcelona are pivotal, with a competitive landscape featuring both local and international players like Vimeo and Brightcove.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe holds a market value of $975.0 million, accounting for 24% of the overall European market. Growth is driven by diverse regional demands and varying levels of digital adoption. Government initiatives across countries support digital infrastructure development. Key markets include the Nordics and Eastern Europe, where local players and international firms like Panopto are competing in various sectors, including healthcare and education.