Focus on Enhanced User Experience

In the competitive landscape of the enterprise video market, there is a pronounced focus on enhancing user experience. Companies are increasingly prioritizing intuitive interfaces and seamless integration with other tools to improve user satisfaction. Research indicates that organizations that invest in user-friendly video solutions experience a 25% increase in employee engagement during virtual meetings. This emphasis on user experience is crucial for retaining clients and attracting new users in a crowded market. As a result, the enterprise video market is likely to see continued innovation aimed at simplifying the user journey and maximizing engagement.

Expansion of Mobile Video Solutions

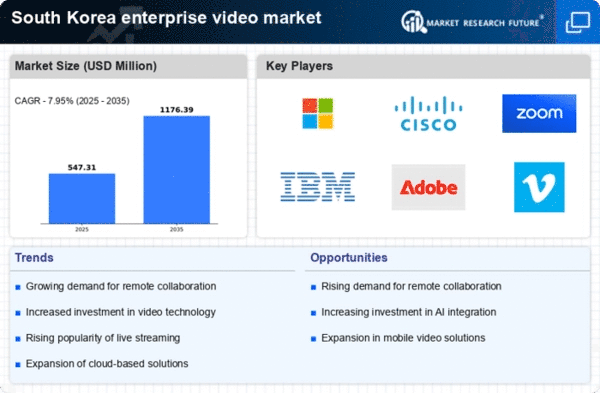

The enterprise video market in South Korea is witnessing an expansion of mobile video solutions, driven by the increasing use of smartphones and tablets in professional settings. As mobile technology continues to advance, employees expect the ability to access video conferencing and collaboration tools on-the-go. This shift is reflected in the growing number of mobile applications designed for video communication, which are projected to capture a significant share of the market. Analysts estimate that mobile video solutions could account for over 40% of total video conferencing usage by 2026. This trend underscores the necessity for the enterprise video market to innovate and adapt to mobile-first strategies.

Growing Emphasis on Training and Development

The enterprise video market in South Korea is increasingly influenced by the growing emphasis on training and development programs. Companies are recognizing the value of video content in delivering effective training sessions, particularly in a remote work context. Video-based learning solutions are becoming essential for onboarding new employees and upskilling existing staff. Data indicates that organizations utilizing video for training report a 50% increase in knowledge retention compared to traditional methods. This trend highlights the potential of video as a powerful tool for enhancing workforce capabilities, thereby propelling the enterprise video market forward.

Rising Demand for Remote Collaboration Tools

The enterprise video market in South Korea experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing platforms, which facilitate real-time interaction, are witnessing heightened usage. According to recent data, the market for video conferencing solutions is projected to grow by approximately 15% annually. This trend indicates a shift towards more flexible work environments, where employees can connect seamlessly from various locations. Consequently, the enterprise video market is adapting to meet these evolving needs, offering innovative features that enhance user experience and engagement.

Investment in Digital Transformation Initiatives

In South Korea, businesses are significantly investing in digital transformation initiatives, which directly impacts the enterprise video market. Organizations recognize the importance of leveraging technology to improve operational efficiency and customer engagement. As a result, the demand for video solutions that integrate with existing digital infrastructures is on the rise. Reports suggest that companies are allocating up to 30% of their IT budgets towards digital transformation efforts, which includes upgrading video communication tools. This investment not only enhances internal collaboration but also improves customer interactions, thereby driving growth within the enterprise video market.