Emergence of 5G Technology

The rollout of 5G technology is poised to have a transformative impact on the data center-colocation market. With its promise of faster data transmission and lower latency, 5G is expected to drive demand for colocation services that can support the increased data traffic generated by connected devices. In Europe, the expansion of 5G networks is likely to create new opportunities for colocation providers, as businesses seek to enhance their connectivity and data processing capabilities. The data center-colocation market may experience growth as organizations invest in infrastructure that can accommodate the demands of 5G technology, potentially leading to a surge in colocation service adoption.

Growing Need for Data Security

The increasing frequency of cyber threats and data breaches has heightened the focus on data security within the data center-colocation market. Organizations are increasingly seeking colocation services that offer robust security measures, including advanced firewalls, intrusion detection systems, and physical security protocols. In Europe, the demand for secure data handling is underscored by regulations such as the General Data Protection Regulation (GDPR), which mandates stringent data protection standards. As a result, the data center-colocation market is witnessing a surge in investments aimed at enhancing security features, with some providers reporting up to a 30% increase in demand for secure colocation solutions. This trend indicates that businesses are prioritizing data security, thereby driving growth in the data center-colocation market.

Increased Focus on Hybrid IT Solutions

The shift towards hybrid IT environments is reshaping the landscape of the data center-colocation market. Organizations are increasingly adopting a mix of on-premises and cloud solutions to optimize their IT infrastructure. This trend is particularly pronounced in Europe, where businesses are looking for flexible colocation options that can seamlessly integrate with their existing systems. The demand for hybrid solutions is expected to drive the data center-colocation market, as companies seek to balance the benefits of cloud computing with the control of on-premises resources. As a result, colocation providers are adapting their offerings to meet this demand, potentially leading to a more competitive market landscape.

Rising Energy Costs and Efficiency Demands

As energy costs continue to rise, organizations are increasingly seeking energy-efficient solutions within the data center-colocation market. The demand for colocation services that utilize advanced cooling technologies and energy-efficient hardware is on the rise. In Europe, energy efficiency is not only a cost-saving measure but also a regulatory requirement, with many countries implementing strict energy consumption guidelines. This has led to a growing number of colocation providers investing in green technologies, such as renewable energy sources and energy-efficient designs. The potential for reduced operational costs and compliance with environmental regulations is driving businesses to opt for colocation services, thereby enhancing the growth prospects of the data center-colocation market.

Expansion of Digital Transformation Initiatives

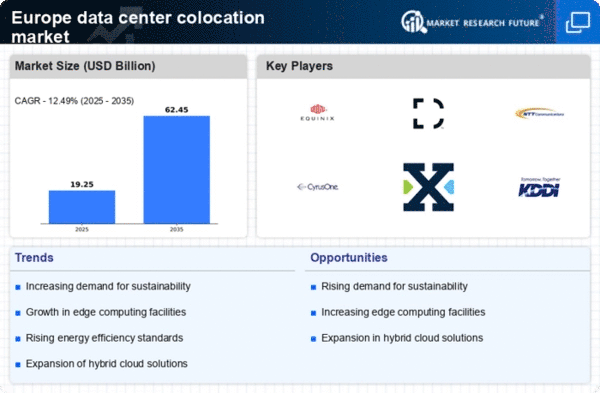

The ongoing digital transformation across various sectors is significantly influencing the data center-colocation market. Organizations are increasingly adopting digital technologies to enhance operational efficiency and customer engagement. This shift is leading to a greater reliance on colocation services, as businesses seek to leverage scalable infrastructure without the burden of managing physical data centers. In Europe, the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for agile and flexible IT solutions. Companies are recognizing that colocation can provide the necessary resources to support their digital initiatives, thus propelling the data center-colocation market forward.