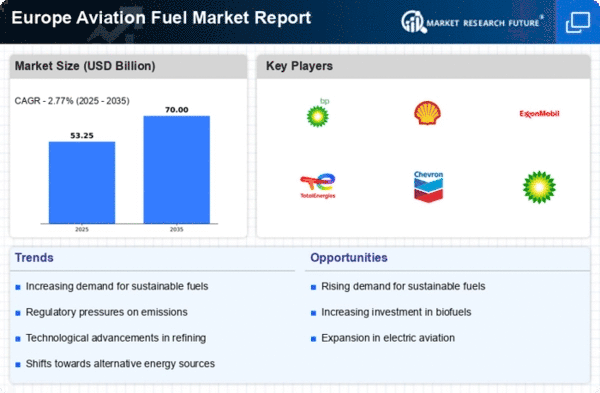

Rising Air Travel Demand

The aviation fuel market in Europe is experiencing a surge in demand due to increasing air travel. With passenger numbers expected to reach pre-pandemic levels, the International Air Transport Association (IATA) forecasts a growth rate of around 4.5% annually in air traffic. This rising demand for air travel directly correlates with the need for aviation fuel, as airlines strive to meet passenger expectations. Consequently, the aviation fuel market is under pressure to ensure a stable supply of fuel to accommodate this growth. Additionally, the expansion of low-cost carriers and the introduction of new routes further contribute to the heightened demand for aviation fuel, necessitating strategic planning and investment in fuel infrastructure.

Economic Recovery and Investment

The aviation fuel market in Europe is poised for growth as economic recovery continues to gain momentum. Increased investments in the aviation sector are anticipated, driven by a resurgence in business travel and tourism. The European economy is projected to grow by approximately 2.5% in 2025, which may lead to higher disposable incomes and increased travel spending. This economic environment encourages airlines to expand their fleets and routes, thereby increasing the demand for aviation fuel. The aviation fuel market must adapt to these changing economic conditions, ensuring that fuel supply chains are robust and capable of meeting the anticipated rise in consumption. Strategic partnerships and investments in infrastructure will be crucial for sustaining growth in this dynamic market.

Regulatory Framework Enhancements

The aviation fuel market in Europe is currently influenced by stringent regulatory frameworks aimed at reducing carbon emissions. The European Union has implemented various directives that mandate lower carbon intensity in aviation fuels. This regulatory environment encourages investments in sustainable aviation fuel (SAF) production, which is projected to account for approximately 30% of total aviation fuel consumption by 2030. Compliance with these regulations is essential for airlines and fuel suppliers, driving innovation and adoption of cleaner fuel alternatives. The aviation fuel market must navigate these regulations while ensuring operational efficiency and cost-effectiveness. As a result, the regulatory landscape is a significant driver, shaping the future of fuel sourcing and consumption patterns across Europe.

Environmental Sustainability Initiatives

The aviation fuel market in Europe is significantly influenced by environmental sustainability initiatives. As public awareness of climate change grows, there is increasing pressure on the aviation sector to adopt greener practices. Airlines are actively seeking to reduce their carbon footprints, which has led to a heightened interest in sustainable aviation fuels. The aviation fuel market is responding to this demand by exploring partnerships with biofuel producers and investing in research for cleaner fuel alternatives. The European Union's commitment to achieving net-zero emissions by 2050 further underscores the importance of sustainability in the aviation sector. This focus on environmental responsibility is likely to drive innovation and investment in sustainable fuel technologies, shaping the future of the aviation fuel market.

Technological Innovations in Fuel Production

The aviation fuel market in Europe is being propelled by technological innovations in fuel production processes. Advances in refining technologies and the development of alternative fuels are reshaping the landscape of aviation fuel supply. For instance, the introduction of biofuels and synthetic fuels is gaining traction, with production capacities expected to increase significantly in the coming years. The aviation fuel market is likely to benefit from these innovations, as they offer potential cost savings and reduced environmental impact. Furthermore, the European Commission's support for research and development in sustainable fuel technologies indicates a commitment to fostering innovation within the sector, which could lead to a more resilient and sustainable aviation fuel market.