Environment Health Safety Market Summary

As per Market Research Future analysis, the Environment Health and Safety Market Size was estimated at 8.325 USD Billion in 2024. The Environment Health and Safety industry is projected to grow from 9.066 USD Billion in 2025 to 21.27 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 8.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Environment Health and Safety Market is experiencing a dynamic shift towards technological integration and sustainability.

- Technological integration is reshaping the Environment Health and Safety Market, enhancing operational efficiency and compliance.

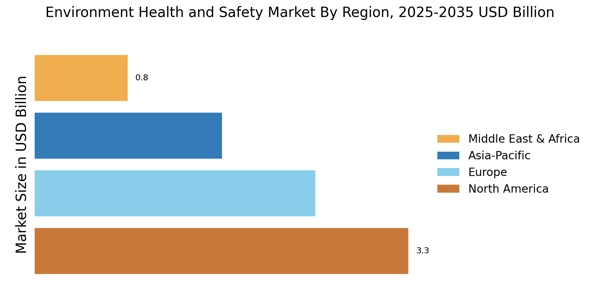

- North America remains the largest market, driven by stringent regulatory compliance and advanced technological solutions.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing public awareness and sustainability initiatives.

- The Solutions segment leads the market, while the Services segment is rapidly expanding, supported by technological advancements and workforce training initiatives.

Market Size & Forecast

| 2024 Market Size | 8.325 (USD Billion) |

| 2035 Market Size | 21.27 (USD Billion) |

| CAGR (2025 - 2035) | 8.9% |

Major Players

Bureau Veritas (FR), SGS (CH), Intertek Group (GB), TÜV SÜD (DE), DNV GL (NO), Aon (GB), EHS Support (US), Sphera (US), ERM (GB), WSP Global (CA)