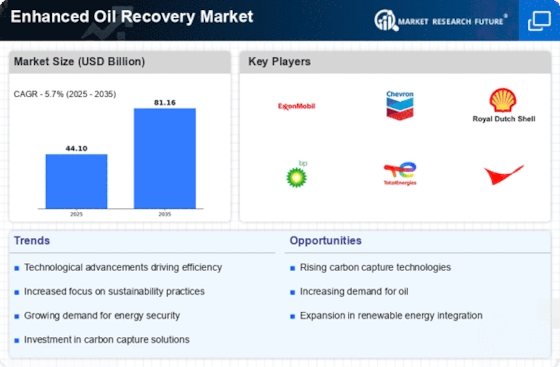

Top Industry Leaders in the Enhanced Oil Recovery Market

*Disclaimer: List of key companies in no particular order

The Enhanced Oil Recovery (EOR) market represents a dynamic and rapidly evolving space, driven by the imperative to maximize resource extraction from depleting conventional reserves. Within this landscape, a diverse array of players operates, each employing distinct strategies to secure market share and navigate the intricacies of this resource-intensive industry.

Key Players and Their Strategies:

-

Oil and Gas Majors: Companies like ExxonMobil, BP, and Shell wield substantial financial resources and technological prowess. This allows them to invest significantly in R&D for advanced EOR methods and acquire innovative smaller players. Their global reach and established infrastructure provide a significant edge in executing large-scale projects.

-

National Oil Companies (NOCs): Entities like Saudi Aramco, Petrobras, and CNPC possess access to vast reserves and enjoy governmental backing. This allows them to focus on tailoring EOR techniques to specific reservoirs and geological conditions. Collaborations with technology providers and universities foster local innovation, reducing dependence on foreign players.

-

Service Providers: Schlumberger, Halliburton, and Baker Hughes offer a suite of EOR services, ranging from reservoir characterization to project implementation. Their diversified service portfolios cater to diverse operator needs, enabling them to capture market share even in regions with limited resource ownership.

-

Technology Start-ups: Emerging entities such as Coda Resources and C3.ai leverage cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) to optimize EOR processes. Their aim is to enhance efficiency and cost-effectiveness, challenging established players by offering innovative solutions.

Factors Influencing Market Share Analysis:

-

EOR Technology Portfolio: Companies boasting a broad spectrum of proven EOR methods, including thermal, chemical, and miscible gas technologies, are better equipped to address diverse reservoir types and project requirements. Adaptability to specific geological conditions is pivotal for securing substantial contracts.

-

Operational Efficiency and Execution Capabilities: Timely project completion within budget is critical given the industry's high upfront costs. Companies with established project management expertise and skilled personnel stand out in winning projects over competitors boasting higher theoretical efficiency claims.

-

Geographical Presence and Regional Focus: Firms with robust regional footprints and strategic alliances with local entities navigate regulatory hurdles better and secure access to crucial resources. Understanding local preferences and aligning technologies accordingly is pivotal for success.

-

Technological Innovation and R&D Investment: Continuous innovation in EOR methods, materials, and data analysis tools is vital for sustained competitiveness. Companies making aggressive R&D investments and forging research partnerships gain an edge in developing superior and cost-effective solutions.

Emerging Trends and Company Strategies:

-

Digitalization and Data-Driven EOR: The adoption of AI and ML algorithms to optimize field operations and predict reservoir behavior gains traction. Companies like Schlumberger invest substantially in digital tools and data analytics platforms to deliver smarter EOR solutions.

-

Focus on Environmental Sustainability: Rising concerns about carbon emissions and environmental impact drive the development of greener EOR methods. Companies explore biopolymers, CO2 capture, and utilization technologies to differentiate themselves in a sustainability-conscious market.

-

Collaborative Partnerships and Joint Ventures: Companies increasingly form partnerships across the value chain to share risks, access expertise, and expand resource pools. Collaborations between oil majors, service providers, and technology startups accelerate innovation and project execution.

The EOR market is poised for continued growth, driven by escalating energy demands, technological strides, and strategic partnerships. While competition remains intense, the market presents opportunities for players with diverse strengths. Major oil and gas entities will dominate due to their resources and global reach. However, service providers and innovative startups can carve out niches via specialized services and cutting-edge solutions. Adaptation to new technologies, sustainability focus, and collaborative partnerships will be pivotal in this dynamic and evolving landscape.

Industry Developments and Latest Updates:

- Praxair Technology, Inc. announced a partnership with U.S. Silica for low-carbon EOR solutions employing CO2 capture and utilization technologies.

- PJSC Lukoil Oil Company successfully tested a new polymer flooding technology, reportedly increasing oil recovery by 15%.

- FMC Technologies, Inc. showcased its latest EOR solutions, including advanced subsea pumps and intelligent well completions, at a major technical conference.

- Chevron Phillips Chemical Corporation announced a collaboration with the National Energy Technology Laboratory (NETL) for developing next-gen EOR polymers.

- Schlumberger launched its new "EVEREST" EOR platform, integrating reservoir characterization, well placement, and stimulation expertise for optimized EOR strategies.