Aging Oil Fields

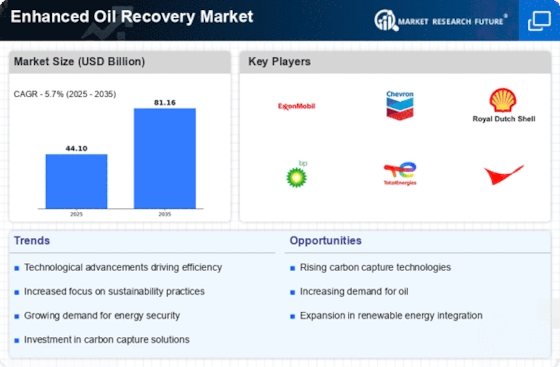

The prevalence of aging oil fields is a significant driver for the Enhanced Oil Recovery Market. Many oil fields around the world are reaching the end of their productive life, with conventional extraction methods yielding diminishing returns. Enhanced oil recovery techniques are increasingly viewed as essential to revitalizing these mature fields. It is estimated that enhanced oil recovery can potentially recover an additional 30 to 60% of the original oil in place, making it a viable solution for operators facing declining production rates. As companies seek to maximize the value of their existing assets, the demand for enhanced recovery solutions is expected to rise, further propelling market growth.

Increasing Energy Demand

The Enhanced Oil Recovery Market is experiencing a surge in demand for energy, driven by the growing global population and industrialization. As economies expand, the need for oil and gas increases, prompting companies to seek methods to maximize extraction from existing fields. Enhanced oil recovery techniques, such as thermal recovery and gas injection, are becoming essential to meet this demand. According to recent estimates, the global energy consumption is projected to rise by approximately 30% by 2040, necessitating innovative solutions in oil recovery. This trend indicates a robust market for enhanced oil recovery technologies, as they enable operators to extract additional resources from mature fields, thereby extending their productive life and contributing to energy security.

Technological Innovations

Technological advancements play a pivotal role in shaping the Enhanced Oil Recovery Market. Innovations such as advanced seismic imaging, real-time data analytics, and improved drilling techniques are enhancing the efficiency and effectiveness of recovery processes. For instance, the integration of artificial intelligence and machine learning in reservoir management is optimizing production strategies and reducing operational costs. The market for enhanced oil recovery technologies is expected to witness substantial growth, with investments in R&D projected to reach billions of dollars in the coming years. These innovations not only improve recovery rates but also minimize environmental impacts, aligning with the industry's shift towards more sustainable practices.

Environmental Considerations

Environmental concerns are becoming increasingly influential in the Enhanced Oil Recovery Market. As the world shifts towards more sustainable energy practices, enhanced oil recovery methods that minimize environmental impact are gaining traction. Techniques such as CO2 injection not only enhance oil recovery but also contribute to carbon sequestration efforts, addressing climate change challenges. The market is witnessing a growing preference for technologies that reduce water usage and lower greenhouse gas emissions. This shift is likely to drive innovation in enhanced oil recovery methods, as companies strive to meet both regulatory requirements and consumer expectations for environmentally responsible practices. The integration of sustainability into recovery strategies is expected to shape the future landscape of the industry.

Regulatory Support and Policies

The Enhanced Oil Recovery Market benefits from supportive regulatory frameworks and policies aimed at promoting energy independence and sustainability. Governments are increasingly recognizing the importance of enhanced oil recovery as a means to optimize domestic oil production and reduce reliance on imports. Incentives such as tax breaks, grants, and subsidies for companies investing in enhanced recovery technologies are becoming more common. This regulatory support is likely to stimulate market growth, as it encourages investment in innovative recovery methods. Furthermore, policies aimed at reducing carbon emissions may drive the adoption of enhanced oil recovery techniques that capture and store CO2, thereby aligning with global climate goals.