Customer-Centric Business Models

The shift towards customer-centric business models is reshaping the Energy and Utility Analytics Market. Utilities are increasingly recognizing the importance of engaging customers through personalized services and tailored energy solutions. Advanced analytics enable utilities to understand customer preferences and behaviors, facilitating the development of innovative pricing models and demand response programs. In 2025, it is anticipated that customer engagement initiatives will account for over 25% of utility revenue streams. This trend underscores the necessity for utilities to invest in analytics capabilities that enhance customer experience and satisfaction. As a result, the Energy and Utility Analytics Market is likely to witness a surge in demand for solutions that support customer engagement and retention.

Rise of Renewable Energy Sources

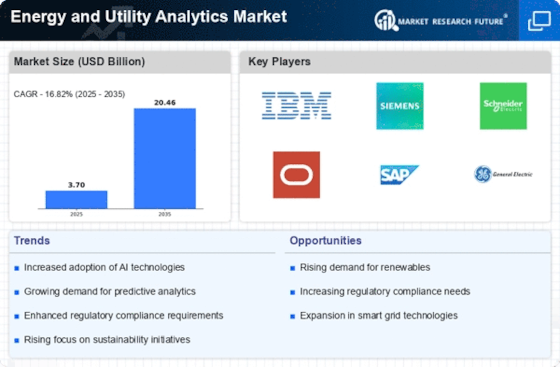

The rise of renewable energy sources is a pivotal driver in the Energy and Utility Analytics Market. As countries strive to transition to cleaner energy, the integration of renewables such as solar and wind into the energy mix presents both challenges and opportunities. Analytics tools are essential for managing the variability and intermittency associated with renewable energy generation. The market for analytics solutions tailored to renewable energy is projected to grow at a compound annual growth rate of 20% through 2027. This growth is indicative of the increasing reliance on data analytics to optimize the performance of renewable assets and ensure grid stability. Consequently, the Energy and Utility Analytics Market is evolving to meet the demands of a more sustainable energy landscape.

Integration of Big Data Analytics

The integration of big data analytics into the Energy and Utility Analytics Market is transforming how organizations manage their operations. By harnessing vast amounts of data from various sources, companies can gain insights into energy consumption patterns, optimize resource allocation, and enhance operational efficiency. The market for big data analytics in energy is projected to reach USD 23 billion by 2026, indicating a robust growth trajectory. This integration allows utilities to predict demand fluctuations and manage supply more effectively, thereby reducing costs and improving service delivery. As organizations increasingly rely on data-driven decision-making, the Energy and Utility Analytics Market is likely to see a surge in demand for advanced analytics solutions.

Regulatory Compliance and Standards

Regulatory compliance plays a crucial role in shaping the Energy and Utility Analytics Market. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and promoting sustainable practices. Compliance with these regulations necessitates the adoption of advanced analytics tools that can monitor and report on energy usage and emissions. The market for compliance-related analytics solutions is expected to grow significantly, driven by the need for utilities to adhere to evolving standards. In 2025, it is estimated that compliance costs could account for up to 15% of total operational expenses for utilities. Thus, the Energy and Utility Analytics Market is increasingly focused on providing solutions that facilitate compliance while enhancing operational transparency.

Investment in Smart Grid Technologies

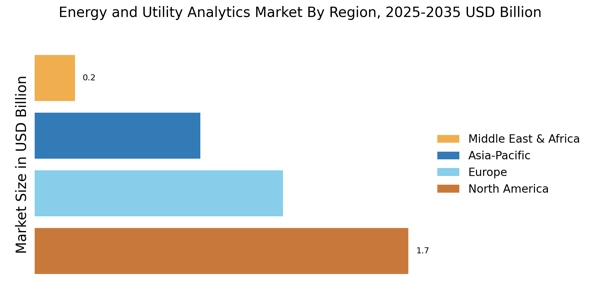

Investment in smart grid technologies is a significant driver of the Energy and Utility Analytics Market. Smart grids leverage advanced communication and analytics technologies to enhance the efficiency and reliability of energy distribution. The Energy and Utility Analytics is projected to reach USD 100 billion by 2026, reflecting a growing emphasis on modernization and infrastructure upgrades. Analytics play a critical role in smart grid operations, enabling real-time monitoring, predictive maintenance, and demand forecasting. As utilities invest in smart grid initiatives, the demand for analytics solutions that support these technologies is expected to rise. This trend indicates a transformative shift in the Energy and Utility Analytics Market, as organizations seek to harness the full potential of smart grid capabilities.