Regulatory Support

Regulatory support plays a crucial role in shaping the Energy Efficient Motor Market. Governments worldwide are implementing stringent regulations aimed at reducing energy consumption and promoting sustainable practices. For instance, energy efficiency standards and labeling programs encourage manufacturers to produce more efficient motors. These regulations not only drive innovation but also create a competitive landscape where energy-efficient products are favored. The market is projected to grow as compliance with these regulations becomes mandatory for manufacturers. In fact, it is estimated that the implementation of energy efficiency standards could lead to a market growth rate of approximately 5% annually. This regulatory environment fosters a culture of sustainability within the Energy Efficient Motor Market, compelling companies to invest in energy-efficient technologies.

Rising Energy Costs

Rising energy costs are significantly influencing the Energy Efficient Motor Market. As energy prices continue to escalate, businesses are increasingly seeking ways to minimize their energy expenditures. Energy-efficient motors offer a viable solution, as they consume less power and can lead to substantial savings over time. It is estimated that companies can save up to 20% on energy costs by switching to energy-efficient motors. This financial incentive is compelling, particularly for industries with high energy consumption, such as manufacturing and mining. Consequently, the demand for energy-efficient motors is likely to increase as organizations prioritize cost-effective solutions. The focus on reducing operational costs while maintaining productivity positions the Energy Efficient Motor Market as a critical player in the broader energy landscape.

Environmental Concerns

Environmental concerns are increasingly driving the Energy Efficient Motor Market. As awareness of climate change and environmental degradation grows, industries are under pressure to adopt sustainable practices. Energy-efficient motors contribute to lower greenhouse gas emissions and reduced energy consumption, aligning with global sustainability goals. Many companies are now prioritizing eco-friendly solutions, which has led to a surge in demand for energy-efficient technologies. Market analysis suggests that the shift towards sustainability could result in a market growth rate of approximately 7% in the coming years. This trend reflects a broader commitment to environmental stewardship within the Energy Efficient Motor Market, as businesses recognize the importance of reducing their ecological footprint while enhancing operational efficiency.

Technological Advancements

The Energy Efficient Motor Market is experiencing a surge in technological advancements that enhance motor efficiency and performance. Innovations such as variable frequency drives and smart motor systems are becoming increasingly prevalent. These technologies not only improve energy efficiency but also reduce operational costs for businesses. According to recent data, energy-efficient motors can reduce energy consumption by up to 30% compared to traditional motors. This shift towards advanced technologies is likely to drive the market forward, as industries seek to optimize their energy usage and reduce their carbon footprint. Furthermore, the integration of IoT in motor systems allows for real-time monitoring and predictive maintenance, which can further enhance efficiency and reliability in the Energy Efficient Motor Market.

Growing Demand in Emerging Markets

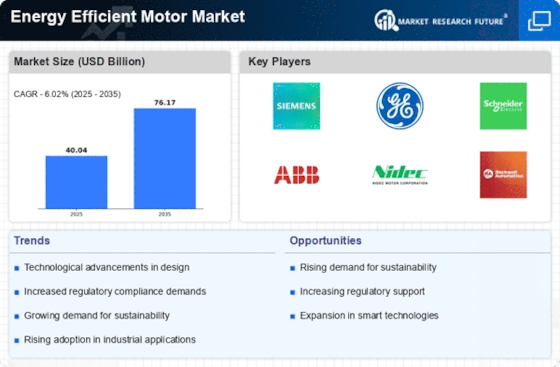

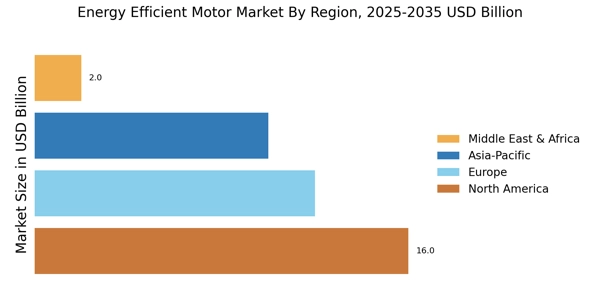

The Energy Efficient Motor Market is witnessing a growing demand in emerging markets, where industrialization and urbanization are rapidly increasing. As these regions develop, there is a heightened awareness of energy efficiency and its benefits. Industries in emerging markets are increasingly adopting energy-efficient motors to reduce operational costs and comply with international standards. This trend is particularly evident in sectors such as manufacturing, HVAC, and transportation. Market data indicates that the demand for energy-efficient motors in these regions is expected to grow at a compound annual growth rate of around 6% over the next five years. This growth is driven by the need for sustainable solutions that align with global energy efficiency goals, making the Energy Efficient Motor Market a focal point for investment and development.