Top Industry Leaders in the Energy Efficient Motor Market

*Disclaimer: List of key companies in no particular order

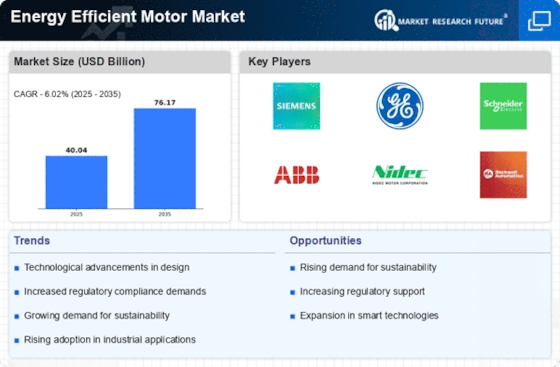

The global market for energy-efficient motors is gearing up, propelled by escalating energy expenses, ambitious decarbonization objectives, and stringent regulations. Yet, who are the pivotal actors, what tactics are they employing, and what nascent trends are molding the competitive panorama?

Dominators and Ascendant Luminary Stars:

The arena features entrenched behemoths like ABB, Siemens, Regal Rexnord, and Nidec leveraging their global influence, established distribution grids, and robust brand acknowledgment. Conversely, local contenders such as Brazil's WEG and Taiwan's TECO Electric are etching out their domains, often holding a cost-effective advantage. Remarkably, Chinese manufacturers like Wolong Electric are making substantial progress, attracting attention with their emphasis on value propositions tailored to emerging markets.

Strategic Maneuvers in Progress: Companies are adopting varied approaches to gain traction. Innovation stands paramount, with entities investing in the research and development of cutting-edge motor technologies such as permanent magnet synchronous motors (PMSMs) and high-efficiency inverter drives. ABB's SynRM motors and Siemens' IE5 Super Premium Efficiency motors epitomize this endeavor.

Moreover, collaborations and acquisitions are hastening market penetration. Associations with system integrators and distributors broaden reach, while acquiring regional entities provides entry into novel markets and access to fresh talent. Nidec's acquisition of Motor Controls Group embodies this trend.

Another pivotal strategy involves customization and service differentiation. Grasping diverse customer requisites and furnishing bespoke solutions, encompassing energy assessments, retrofitting services, and lifecycle management, holds significance. Regal Rexnord's Encompass® program illustrates this methodology.

Market Share Scrutiny: Beyond Magnitude, It's the Assortment: Analyzing market share necessitates delving beyond mere size. Geographical presence, application focus, and diversity in product portfolios emerge as pivotal factors. For instance, WEG commands a robust share in Latin America's agricultural sector, while Nidec dominates the Asian market for high-efficiency industrial motors.

Technological preeminence also carries substantial weight. Companies excelling in PMSM or IE5 motors attract a niche clientele willing to pay a premium for cutting-edge efficiency. Siemens, with its emphasis on IE5 motors, exemplifies this positioning.

Evolving Trends: The Path Forward: Several trends are reshaping the competitive landscape. The infusion of intelligent technologies like sensors and connectivity into motors facilitates real-time performance monitoring and predictive maintenance, creating novel value streams. Companies like ABB and WEG are already proffering such solutions.

Sustainability is another driving force. Environmentally friendly materials and processes are gaining traction, with manufacturers like TECO Electric concentrating on low-carbon footprint motors. Additionally, the circular economy, encompassing motor recycling and refurbishment, is gaining momentum, with initiatives like Siemens' "Motor ReMan" program exhibiting potential.

The Drama of Competition Unfolds: The energy-efficient motor market stands as a dynamic stage where established entities, regional luminaries, and technological innovators all vie for supremacy. To thrive, companies must perpetually adapt, embrace innovation, and cater to evolving customer needs, all while keeping an eye on sustainability and the circular economy. The battle for market share promises to be riveting, with efficiency and innovation as the ultimate weapons of choice.

While this analysis offers a snapshot of the competitive landscape, the narrative is far from concluded. As regulations tighten, technologies evolve, and customer demands shift, the game will persist in evolving, presenting captivating opportunities for those adept at navigating the shifting currents and emerging as true efficiency champions.

Industry Developments and Latest Updates:

- Dec 15, 2023: ABB unveils new IE5 SynRM motors for industrial applications, boasting efficiency levels up to 97% (source: ABB press release).

- Oct 26, 2023: Siemens introduces Simogear IE5 geared motors with efficiency levels reaching up to 96.5% (source: Siemens website).

- Dec 07, 2023: Rockwell Automation launches new PowerFlex 7000 AC drives for efficient motor control in industrial processes (source: Rockwell Automation website).

- Dec 12, 2023: Schneider Electric reveals Lexium LMD 75 servo drives for enhanced energy efficiency in machine control applications (source: Schneider Electric website).

- Dec 08, 2023: Crompton Greaves introduces new IE5 high-efficiency motors for pumps and fans, surpassing government regulations (source: Crompton Greaves website).

- Nov 29, 2023: Kirloskar Electric launches IE5 Premium motors with efficiency levels surpassing 96% for industrial applications (source: Kirloskar Electric website).