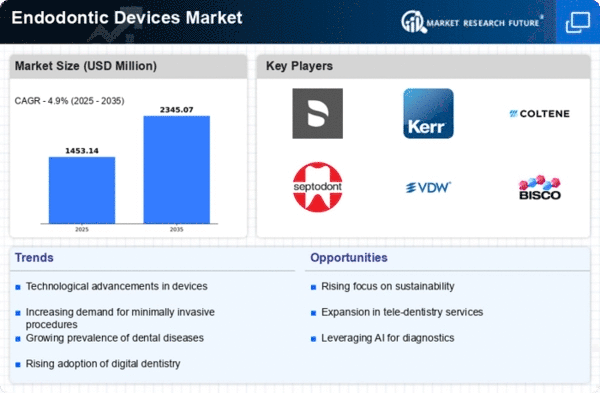

Market Growth Projections

The Global Endodontic Devices Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 2.35 USD Billion by 2035, the industry is on a trajectory of expansion. The compound annual growth rate of 4.89% from 2025 to 2035 indicates a robust demand for endodontic devices, driven by various factors including technological advancements, rising dental disease prevalence, and increased awareness of oral health. This growth presents opportunities for manufacturers and healthcare providers to innovate and enhance their offerings in the endodontic sector.

Technological Advancements

The Global Endodontic Devices Market Industry is experiencing a surge in technological advancements that enhance the efficiency and effectiveness of endodontic procedures. Innovations such as rotary endodontic instruments and advanced imaging technologies, including cone-beam computed tomography, are becoming increasingly prevalent. These advancements not only improve treatment outcomes but also reduce procedural time, which is crucial in a clinical setting. As a result, the market is projected to grow from 1.39 USD Billion in 2024 to 2.35 USD Billion by 2035, reflecting a growing demand for sophisticated endodontic solutions.

Regulatory Support and Standards

The Global Endodontic Devices Market Industry benefits from regulatory support and established standards that ensure the safety and efficacy of dental devices. Regulatory bodies are actively involved in the approval and monitoring of endodontic products, which instills confidence among dental professionals and patients alike. This regulatory framework not only facilitates the introduction of new technologies but also promotes adherence to quality standards in manufacturing. As a result, the market is likely to witness sustained growth, driven by the assurance of safety and effectiveness in endodontic treatments.

Rising Incidence of Dental Diseases

The Global Endodontic Devices Market Industry is significantly influenced by the rising incidence of dental diseases, particularly among the aging population. Conditions such as pulpitis and periapical diseases necessitate endodontic treatments, thereby driving the demand for specialized devices. According to health statistics, dental caries and periodontal diseases are prevalent, leading to an increase in root canal treatments. This trend is expected to contribute to a compound annual growth rate of 4.89% from 2025 to 2035, indicating a robust market growth trajectory fueled by the need for effective endodontic interventions.

Increasing Awareness and Preventive Care

There is a growing awareness regarding oral health and preventive care, which is positively impacting the Global Endodontic Devices Market Industry. Educational initiatives and campaigns aimed at promoting dental hygiene are encouraging individuals to seek timely dental care, including endodontic treatments. This heightened awareness is likely to lead to an increase in routine dental check-ups and subsequent endodontic procedures. As more patients become informed about the importance of preserving natural teeth, the demand for endodontic devices is expected to rise, further propelling market growth.

Expansion of Dental Clinics and Practices

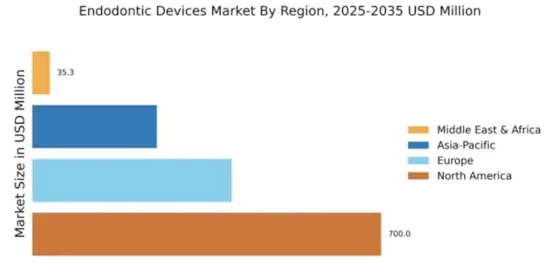

The expansion of dental clinics and practices globally is a crucial driver for the Global Endodontic Devices Market Industry. As more dental professionals establish practices, the availability of endodontic services increases, leading to higher patient access to necessary treatments. This expansion is particularly evident in emerging markets, where the establishment of new clinics is on the rise. Consequently, the demand for endodontic devices is expected to grow, supporting the overall market expansion. The increasing number of dental practitioners is likely to enhance competition, thereby fostering innovation and improving service delivery in endodontics.