Growing Awareness of Oral Health

There is a notable increase in awareness regarding oral health among the US population, which is positively influencing the endodontic devices market. Educational campaigns and initiatives by dental associations have led to a greater understanding of the importance of preventive care and timely treatment of dental issues. This heightened awareness encourages individuals to seek dental care proactively, resulting in a higher demand for endodontic procedures. As patients become more informed about the consequences of untreated dental conditions, the endodontic devices market is expected to benefit from this trend. The focus on maintaining oral health is likely to drive the adoption of advanced endodontic devices, as practitioners aim to meet the growing expectations of their patients.

Rising Incidence of Dental Diseases

The increasing prevalence of dental diseases in the US is a primary driver for the endodontic devices market. According to the American Dental Association, nearly 50% of adults aged 30 and older exhibit some form of periodontal disease. This rising incidence necessitates advanced endodontic treatments, thereby boosting the demand for innovative devices. As dental professionals seek to provide effective solutions, the endodontic devices market is likely to experience growth. The need for root canal treatments and other endodontic procedures is expected to rise, leading to an increased adoption of advanced technologies. This trend indicates a robust market potential, as dental practitioners invest in high-quality endodontic devices to enhance patient outcomes and operational efficiency.

Increase in Dental Insurance Coverage

The expansion of dental insurance coverage in the US significantly drives the endodontic devices market. As more individuals gain access to dental insurance, the financial barriers to receiving endodontic treatments are reduced. This trend is likely to lead to an increase in the number of patients seeking root canal therapies and other endodontic procedures. According to the National Association of Dental Plans, approximately 77% of Americans had some form of dental coverage in 2025, which is expected to further increase. Consequently, the endodontic devices market may experience growth as dental practices are better equipped to handle the rising patient volume and invest in advanced devices to enhance treatment outcomes.

Technological Innovations in Endodontics

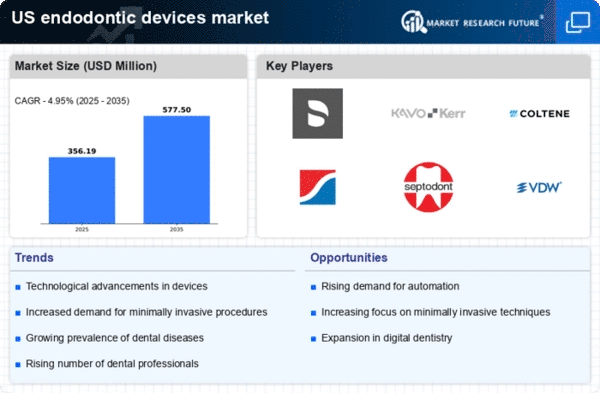

Technological advancements play a crucial role in shaping the endodontic devices market. Innovations such as rotary endodontic instruments, digital imaging, and 3D printing are revolutionizing the way dental procedures are performed. These technologies enhance precision, reduce treatment time, and improve patient comfort. For instance, the introduction of nickel-titanium rotary files has significantly increased the success rates of root canal treatments. The market for endodontic devices is projected to grow at a CAGR of approximately 6% over the next few years, driven by these technological innovations. As dental practices adopt these advanced tools, the endodontic devices market is likely to expand, reflecting the ongoing commitment to improving dental care.

Aging Population and Demand for Dental Care

The aging population in the US is contributing to the growth of the endodontic devices market. As individuals age, they are more susceptible to dental issues, including root canal infections and other endodontic conditions. The US Census Bureau projects that by 2030, all baby boomers will be over 65 years old, leading to a significant increase in the demand for dental care services. This demographic shift is likely to drive the need for effective endodontic treatments, thereby boosting the market for endodontic devices. Dental practitioners are expected to adapt their services to cater to this aging population, which may result in increased investments in advanced endodontic technologies to ensure optimal patient care.