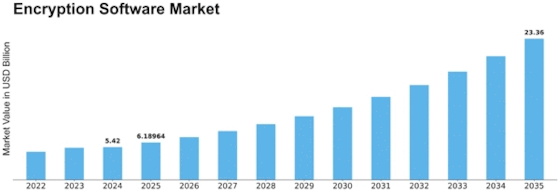

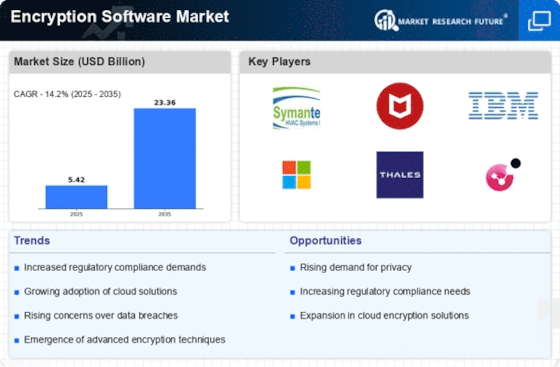

Encryption Software Size

Encryption Software Market Growth Projections and Opportunities

The encryption software market is influenced by many different factors that play an important role in shaping its dynamics. One of these driving forces is the increase in awareness of network security risks and the growing demand for data protection across various sectors. The encryption software market is also significantly influenced by unofficial regulations and compliance standards. Numerous industries, including finance, healthcare, and telecommunications, are subject to strict data protection regulations. Technological advances and ever-increasing cyber threats contribute to the expansion of the market as well. As encryption software vendors develop more sophisticated and efficient solutions, firms must upgrade their security infrastructure to keep up with potential threats. The competition between encryption technology and cybercriminal tactics fuels innovation in the encryption software market. Moreover, the rising adoption of cloud computing and the proliferation of mobile devices boost market growth as well. This necessitates encrypting information as companies move their operations to the cloud while employees access confidential information from different devices. The encryption software landscape is also shaped by rivalry among various suppliers. The sector has a wide range of participants, from well-outlined cybersecurity corporations to niche players focusing solely on providing encryption solutions. In this environment, there are often improvements in features, pricing models, and service offerings, which give customers several alternatives. Global geopolitical dynamics may also impact the encryption software market. Changes in government policies, global diplomatic relations, or international tensions can affect the regulatory environment concerning data security within countries' borders. Also, enterprises' financial situation, coupled with their willingness to invest in cyber defense standards, is part of what drives trends in this area. During times when economies are doing poorly, companies may focus on cost-cutting measures, thereby affecting possible adoption rates for such software. Finally, end user preferences, concerns about customer experience, and integration capabilities impact the acceptance rate for the use of encryption applications. Often, organizations seek solutions that will easily fit into their existing IT infrastructure without causing any disturbances, thereby leading to seamless integrations. Ease of use, implementation efforts, and ability to customize data protection solutions to specific needs are fundamental buying considerations.

Leave a Comment