Top Industry Leaders in the Encryption Software Market

Competitive Landscape of Encryption Software Market:

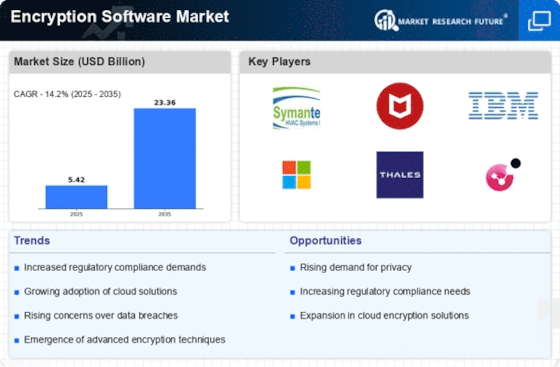

The Encryption Software Market is witnessing a dynamic competitive landscape characterized by a myriad of key players vying for market dominance. Several factors contribute to the intensifying competition, ranging from the growing importance of data security to the increasing number of cyber threats. Among the prominent players, Symantec Corporation, McAfee, LLC, and IBM Corporation stand out as market leaders, leveraging their extensive product portfolios and global presence. These established entities have adopted strategies such as mergers and acquisitions to expand their market reach, solidifying their positions in the encryption software segment.

Key Players:

- Checkpoint Software Technologies Ltd. (Israel)

- Microsoft Corporation (U.S.)

- Sophos Ltd. (U.S.)

- EMC Corporation (U.S.)

- Trend Micro Inc. (Japan)

- Intel Security Group (McAfee) (U.S.)

- Symantec Corporation (U.S.)

- SAS Institute Inc. (U.S.)

- IBM Corporation (U.S.)

Strategies Adopted:

- Mergers and Acquisitions: Market leaders are actively engaging in mergers and acquisitions to enhance their product portfolios and acquire advanced technologies. This strategy allows companies to swiftly adapt to the evolving security landscape.

- Partnerships and Collaborations: Strategic alliances with other technology providers enable companies to offer integrated solutions. By collaborating with complementary entities, key players can provide end-to-end security solutions, catering to diverse customer needs.

- Focus on Innovation: Staying ahead in the encryption software market requires a commitment to innovation. Key players invest heavily in research and development to bring cutting-edge solutions to market, addressing emerging threats and vulnerabilities.

Factors for Market Share Analysis:

- Product Portfolio: The breadth and depth of a company's encryption software offerings play a crucial role in determining market share. Companies with comprehensive and advanced solutions are more likely to capture a larger share of the market.

- Global Presence: The ability to cater to diverse geographic markets enhances a company's market share. Establishing a global footprint allows companies to address regional variations in cybersecurity needs.

- Customer Base: The size and loyalty of a customer base are significant factors. Companies with a large and satisfied customer base are likely to have a higher market share, reflecting the trust and effectiveness of their encryption solutions.

New and Emerging Companies:

Amidst the established players, new and emerging companies are making notable strides in the encryption software market. Entrants like Varonis Systems, Inc., and Vormetric (a Thales Company) are gaining traction with innovative offerings. These companies often focus on niche segments, providing specialized encryption solutions that cater to specific industry requirements.

Current Company Investment Trends:

- Cloud Security Solutions: Companies across the board are increasingly investing in encryption solutions tailored for cloud environments. As organizations migrate to the cloud, securing sensitive data within these platforms becomes paramount, driving investments in cloud-centric encryption technologies.

- Endpoint Security: With the rise of remote work and the proliferation of devices, companies are channeling investments into endpoint security solutions. Encryption software that ensures the protection of data on individual devices is a key focus for current investments.

- Artificial Intelligence (AI) Integration: The incorporation of AI in encryption software is a growing trend. Companies are investing in AI-driven encryption solutions that can adapt and respond to evolving threats in real-time, providing a proactive approach to cybersecurity.

Latest Company Updates:

October 26, 2023:

- Palo Alto Networks acquires CloudCodes: This move strengthens Palo Alto's cloud security offerings, particularly in data encryption.

- Report: The market is expected to grow due to increasing cyberattacks, data privacy regulations, and cloud adoption.

November 15, 2023:

- Microsoft announces new Azure Key Vault features for enhanced data encryption: These features include BYOK (Bring Your Own Key) support and granular access controls.

- Trend Micro launches Ransomware File Encryption Detection tool: This free tool helps organizations identify and prevent ransomware attacks that encrypt files.

December 5, 2023:

- CISA releases guidance on quantum-resistant cryptography: This guidance helps organizations prepare for the potential future threat posed by quantum computers to traditional encryption methods.

- EU Commission proposes new cyber resilience legislation: The proposed law includes stricter requirements for data encryption by businesses.

January 9, 2024:

- Google Cloud introduces Confidential Computing for data protection in the cloud: This technology allows organizations to keep their data encrypted even while it is being processed in the cloud.

- Researchers discover new vulnerabilities in popular encryption algorithms: These vulnerabilities could potentially allow attackers to decrypt sensitive data. However, experts believe the risk is low for most users.