Market Share

Encryption Software Market Share Analysis

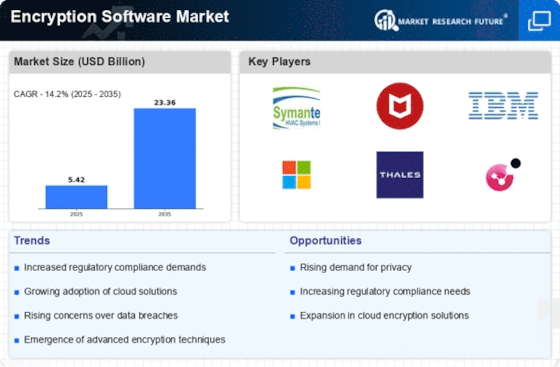

In the Encryption Software Market, which is highly competitive, companies adopt different market share positioning strategies to create a niche for themselves. One popular strategy is differentiation, where firms try to offer unique features or advanced encryption algorithms that differentiate them from competitors. By doing this, they intend to attract a specific segment of the market that values innovation and better security measures. Another frequently used strategy is cost leadership, whereby organizations focus on providing encryption software at lower prices than their competitors do. This caters to price-sensitive buyers and companies looking for budget-friendly options without compromising on essential security aspects. Through competitive pricing, firms can obtain substantial portions of the market, thus achieving economies of scale, which might, in turn, lower production costs even further, cementing their position as a low-cost provider. Market segmentation is also vital to effective market share positioning in the Encryption Software Market. Companies often tailor their offerings to serve specific industries or customer groups. Key firms and collaborations play an important role in expanding market share in the Encryption Software Market. This can be done by forming alliances with other technology providers or through integrating its solutions with widely used platforms such as Microsoft Windows Server 2003 R2. Thus, they increase the market coverage and point out collaborative relationships, where both players gain from joint resources as well as expertise. Continual innovation is a basis for market share positioning strategies in the Encryption Software Market. Firms invest in research and development to keep pace with emerging threats and technological advancements. Regular updates and enhancements on encryption algorithms, user interfaces, and compatibility ensure that customers receive up-to-date solutions. User education and awareness campaigns are vital when gaining market share. Due to encryption being a complex technology, many potential consumers might not fully comprehend its importance or differentiators between various offerings. Companies invest in marketing strategies that emphasize the significance of encryption in safeguarding sensitive data, thus creating demand for their products. Educating buyers about the distinct features and benefits of this software fosters trust-building among the users while positioning the company as a reliable industry expert.

Leave a Comment